Stock Portfolio Selection - Building a Concentrated Portfolio That Outperforms

Willem

Stock Portfolio Selection

By Willem / Originally published: 2019 / How to Invest

Table of Contents

- 1. Stock Portfolio Advice for the Beginner

- 2. The Focused Stock Portfolio

- 3. Concentrate Your Investments to Decrease Risk

- 4. The Number of Stocks in a Portfolio

- 5. Phil Fisher's View on Diversification

- 6. Will an Additional Investment Improve the Portfolio?

- 7. Warren Buffett's View on a Stock Portfolio

- 8. Pros and Cons of Focused Investing

Here we look at building your stock portfolio. First you need to make sure that you understand investment risk and are able to select great businesses. Advice from some of the best investors will help to build a stock portfolio that will grow in value over time. Furthermore, we will explain that a focused portfolio is most likely to beat the market over time.

Stock Portfolio Advice for the Beginner

A fair warning before diving into the focused portfolio: for most investors a portfolio would be optimal if it only contains an Index Fund. This eliminates the chance of selecting the wrong business and comforts most investors since they will never underperform the market (before costs). This advice can also be found in the 1996 letter to shareholders of Warren Buffett:

"Most investors, both institutional and individual, will find that the best way to own common stocks is through an index fund that charges minimal fees. Those following this path are sure to beat the net results (after fees and expenses) delivered by the great majority of investment professionals."

Source: Berkshire Hathaway Letter to Shareholders, 1996

The Focused Stock Portfolio

A focused stock portfolio means that you concentrate your money into a few stocks of which you are very sure that they will be worth more in the future. This can be very risky if you concentrate your money in a bad business or if you lose control over your behavior! It is advised to understand the principles of investing (the investing principles of Warren Buffett) and how to select and value a great business (how Warren Buffett invests in stocks).

It does not make much sense for experienced investors who know what they're doing to buy dozens of companies. Why would you buy a company that you don't understand or that has low returns on capital and a low or even negative free cash flow? Great investors like Warren Buffett and Phil Fisher concentrate their portfolios to decrease risk.

Concentrate Your Investments to Decrease Risk and Increase Performance

In my previous article (understanding investment risk) I explained how one should look at investment risk. In short, investment risk comes from the quality of the business, the management and the price that you pay. Also, your own behavior and investment time (long-term focus) will determine the risk level. In the end, most risk is determined by your attitude towards stocks and the stock market.

Some logic: if you would buy the 500 companies of the S&P 500 you will perform similar to the S&P500 (assume we do this via an index fund that replicates the index including). So, the only way to deviate from the S&P 500 returns is to change your allocation. That is, concentrating your purchases to increase your exposure to a very good business. Investors like Warren Buffett put much of their capital in great businesses like Coca Cola and Apple when the price is low. They think in probabilities: a large margin of safety (low price) for a great stock will mean lower risk and higher returns. This requires extreme discipline.

In sum, you can only outperform the market by focusing on great businesses that you buy at sensible prices. This reduces your investment risk due to the low price for earnings quality. On the other hand, if you don't have the stamina to hold on during periods of underperforming the market (which is likely to occur in the short run), and are unable to analyze businesses, then Index funds are the only thing that makes sense for you!

"Diversification is a protection against ignorance. It makes very little sense for those who know what they're doing."

Charlie Munger, Warren Buffett's business partner

Munger's philosophy is built around the idea of investing heavily in businesses you deeply understand and have great confidence in. You can read more about Charlie Munger's views on concentrated portfolios here.

The Number of Stocks in a Portfolio

Phil Fisher influenced Warren Buffett mostly with his book "Common Stocks, Uncommon Profits". Fisher explained that concentrating on a few good businesses (after extensive research) and holding them, ideally forever, could greatly improve investment returns. Often, very good businesses tend to stay good over time (e.g. Coca Cola). Unfortunately, there are not many Coca Cola's available for good prices most of the time.

Phil Fisher's View on Diversification

Phil Fisher says that investing in 5 large companies that don't have too much overlap (different industries) offers enough diversification. A maximum allocation of 10 percent of your capital is recommended for smaller and younger growth companies.

"Usually a very long list of securities is not a sign of the brilliant investor, but of one who is unsure of himself."

Source: Phil Fisher, Common Stocks, Uncommon Profits

Don't sell stocks because they've increased in value is also great advice on which Warren and Phil both agree. Selling your winners because the share price advanced is like selling Messi due to his high contribution to the goals of FC Barcelona.

It is not necessary to pick 5 stocks at once. This will also be very hard as it is unlikely that 5 great businesses are sold for a fair price at the same time. Especially if the 5 businesses come from different industries. Furthermore, some investors will do well with only 2 or 3 stocks, while others end up with more stocks.

Especially if a stock gets too expensive and money is allocated to another stock. The best way to determine if you add a new stock is to think about whether this will improve the stock portfolio.

Will an Additional Investment Improve the Stock Portfolio?

A very helpful way to look at a potential new investment is to ask yourself: will this stock improve my portfolio characteristics? Compare the potential purchase to what you already own.

The book The Warren Buffett Portfolio (by Robert Hagstrom) mentions that earnings of your stocks (or cash flow), return on equity or the margin of safety should be used as an economic benchmark.

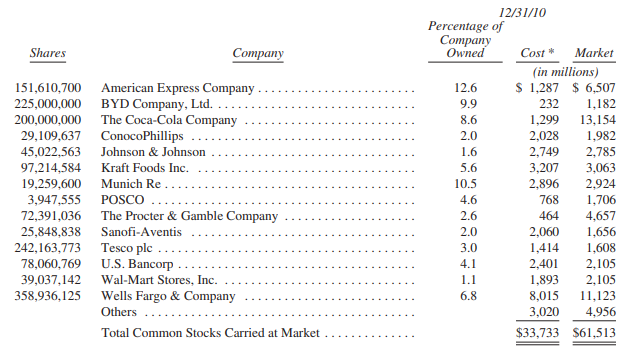

Berkshire Hathaway Stock Portfolio in 2010

An example of a concentrated portfolio. At this moment (December 2019) Apple is the largest stock of Berkshire Hathaway and makes up around 25% of the over $200 billion portfolio. Note that not all of the investments below turned out well. Tesco (a British supermarket) for example declined in value over the years. A good reminder that even stocks in portfolio of the best investors deserve your research before deciding to buy them! Fortunately, most of the money of Berkshire Hathaway is invested in excellent businesses with great economics. So, they can afford a mistake now and then.

Tesco (British Supermarket) stock price 1994-2019. Source: Yahoo Finance

Stock investments of Berkshire Hathaway 2010. Source: Berkshire Hathaway Annual Letter 2010

Warren Buffett's View on a Stock Portfolio

Buffett states his view on portfolio construction in his letter to shareholders. You need to know how to value businesses that you understand and how to think about the market.

"Your goal as an investor should simply be to purchase, at a rational price, a part interest in an easily-understandable business whose earnings are virtually certain to be materially higher five, ten and twenty years from now. Over time, you will find only a few companies that meet these standards - so when you see one that qualifies, you should buy a meaningful amount of stock. You must also resist the temptation to stray from your guidelines: If you aren't willing to own a stock for ten years, don't even think about owning it for ten minutes. Put together a portfolio of companies whose aggregate earnings march upward over the years, and so also will the portfolio's market value."

Source: Berkshire Hathaway Letter to Shareholders, 1996

Be Aware of the Pros and Cons of Focused Investing

It makes much business sense to concentrate your money in good businesses. Most of the richest people in the world have concentrated wealth (e.g. the owners of Amazon, Berkshire Hathaway and Microsoft). Their wealth would be very likely way lower if they had diversified their money over many businesses.

There is absolutely nothing wrong with owning an Index Fund to ensure yourself of the market return and to prevent investing mistakes. A portfolio that only contains a S&P 500 Index Fund is superior to most portfolios (including most professional stock portfolios after costs). But if you want to beat the market, then concentrating in a few understandable and outstanding businesses is the most logical strategy.

Related Articles

- How Warren Buffett Invests in Stocks - Learn the criteria Warren Buffett uses to select great businesses

- An Introduction to ETF Index Investing - Discover why index funds make sense for most investors

- Understanding Investment Risk - Learn the true meaning of investment risk beyond volatility