An Introduction to ETF Index Investing - A Guide for Beginners

Willem

An Introduction to ETF Index Investing

By Willem / Originally published: 15 November 2019 / How to Invest

Table of Contents

ETFs (exchange traded funds) that replicate a stock index like the S&P500 are very popular. Index funds are the best investment for most investors according to Warren Buffett. This makes sense if you realize that most professional and expensive fund managers do not outperform the market. Some basic understanding of ETF index investing based on the book of John Bogle – The Little Book of Common Sense Investing and the advice of Warren Buffett will help you successfully invest in ETFs.

What is an ETF Index Fund?

ETFs that replicate an index are called index funds (learn more about ETFs). You basically have ETF Index funds that are traded like stocks and Mutual Index Funds. ETFs can easily be bought and sold via your broker.

An ETF is a fund that holds a collection of mostly assets like stocks, bonds or commodities (e.g. gold or oil). ETFs are traded on an exchange (e.g. New York Stock Exchange or Euronext). An ETF is not necessarily a market index fund. It can represent an index like the S&P500 (market index ETFs track the index). But also, a stock sector (health care or banking for example) or real estate. Sector ETFs do not offer the broad diversification like an index ETF does.

An index fund is an investment that attempts to track the performance of a specific index (sometimes referred to as a "benchmark") like the popular S&P 500 Index, Nasdaq Composite Index, or Dow Jones Industrial Average. An ETF buys all or a representative sample of the bonds or stocks in the index that the fund tracks.

You also have mutual index funds which are less easy to trade and often require a minimum investment (compare ETFs vs mutual funds). The good thing about mutual index funds is that this makes it harder to sell when you might panic due to adverse market conditions.

In sum, an ETF can be bought and sold on an exchange (hence, exchange traded) and represents a fund which holds a market index or a basket of other investments like bonds.

Benefits of ETF Index Investing

Managing and holding ETFs yourself has great benefits:

- • Select your own allocation

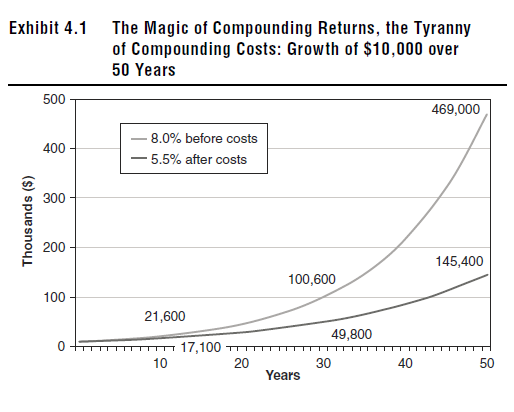

- • Low costs (a few percent a year adds up over the years to thousands of dollars; see graph below)

- • Diversification (eliminate the risk of selecting the wrong stocks)

- • Never underperforming the market

- • Requires very little time and effort

- • Satisfying results over time

Some of the cons for ETF investing could be: you cannot select your own stocks, passive and boring, panicking and selling, and you cannot outperform the market. The return is equal to the market minus the costs (which are very low or even zero for some ETFs).

That being said, it is still very likely to be the best strategy for most investors who do not have the time or capability to select good stocks. Also, mental discipline is needed when underperforming the broader market with selected stocks. This is why investors like Warren Buffett strongly suggest people to buy index funds. It will guarantee a good investment result over time without the need to do any stock research. Just buy and hold the index over time.

Costs are a huge negative factor over time. Source: The Little Book of Common Sense Investing

Examples of ETF Index Funds

Warren Buffett advises the S&P500 as the perfect stock investment (90% allocation). He names the Vanguard Index Fund as his favorite choice. Below you can find some ETF examples that are sound investments and can be bought via your broker. A good advice would be to check the information on the website of the mutual fund and make sure you understand your product (product overview example for the Vanguard S&P 500 ETF).

- • Vanguard S&P 500 ETF (largest 500 US companies)

- • Vanguard Total Stock Market ETF (exposure to the whole world)

- • iShares MSCI Emerging Markets ETF (large exposure to China and other emerging markets)

- • Vanguard FTSE Developed Europe UCITS ETF (600 largest companies of Europe)

- • Vanguard FTSE Japan UCITS ETF (Japanese stocks)

- Summary: With just a few carefully selected ETFs, you can achieve global diversification across different markets and regions while keeping costs extremely low.

Notice that UCITS stands for "Undertakings for the Collective Investment in Transferable Securities". This means that the fund is regulated at a European Union level (this is generally a safe investment).

Why the S&P500 ETF is All You Need

Most S&P500 companies sell their products and services all over the world and earn a substantial amount outside of the USA. So, basically you already have international exposure if you buy the S&P500.

An Example of a Non-Index ETF

Another example is an ETF for dividends. Be aware, that this ETF does not represent an index. So, you can still underperform the market (since you don't buy the index). The Vanguard High Dividend Yield Index Fund has a yield of around 3.2 percent instead of 2 percent for the S&P 500. This ETF selects companies that are established and stable dividend payers. Another famous dividend ETF is the Dividend Aristocrat ETF (for example of the company SPDR).

Bonds Can Ensure a More Stable Portfolio

The book gives a rule of thumb to allocate a percentage equal to your age in bonds. E.g. 50% if you're 50. Bonds can decrease the volatility of the portfolio and can produce more steady income. Although the stock ETF will pay (or reinvest) dividend. The S&P500 pays around 2 percent of dividend (the yield). Over longer periods of time, stocks are very likely to outperform bonds. So, especially younger investors would do better by investing more in stock ETFs.

Warren Buffett advises a short-term government bond fund. These are less sensitive to the interest environment. If the interest rate goes up, bond prices go down (inverse relation). This makes sense since you don't want a bond that pays 2 percent if the general interest rates have increased to for example 3 percent. Bond ETFs save you the trouble of selecting the bonds of one company.

Warren Buffett said that it would be best to allocate 90% to the S&P500 and 10% to short-term government bonds. Notice that you just need 2 ETFs that will give you superb diversification and results over time. In just a couple of minutes of work per month! Letter to Shareholders (2013)

The US economy and businesses are the most trusted place to invest in my opinion. American businesses generate on average more cash and have higher returns on investment than other countries. And the institutions (government policies) of the country provide an optimal business climate.

Classic Index Funds versus New Non-Index Funds

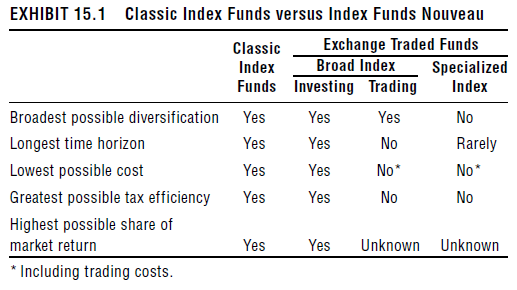

There are thousands of ETFs. The best advice is to just stick with ETFs that cover an index like the ones mentioned above. Only a true representation of an index like the S&P500 will give you the full diversification and market return. The table below provides a good overview of classic index funds versus non-classic index funds (like sector ETFs).

Only market index funds provide the full benefits. Source: The Little Book of Common Sense Investing

Warren Buffett's Advice

Previously, we have already discussed the advice of Warren Buffett that he gave in his Letter to Shareholders (2013). The book further expands on this idea by mentioning the following quote of Warren Buffett:

"By periodically investing in an index fund, the know-nothing investor can actually out-perform most investment professionals. Paradoxically, when 'dumb' money acknowledges its limitations, it ceases to be dumb. Those index funds that are very low cost, are investor-friendly by definition and are the best selection for most of those who wish to own equities."

Source: Berkshire Hathaway Letter to Shareholders, 1993

With 'dumb' Warren Buffett means not knowing which stocks to select that will outperform the market. He also realizes that the average investor does not have the mental discipline.

The attitude of people and lack of doing research and forming the right conclusions. Some lose, some win. But you guarantee yourself the fair market return by investing in a market index ETF.

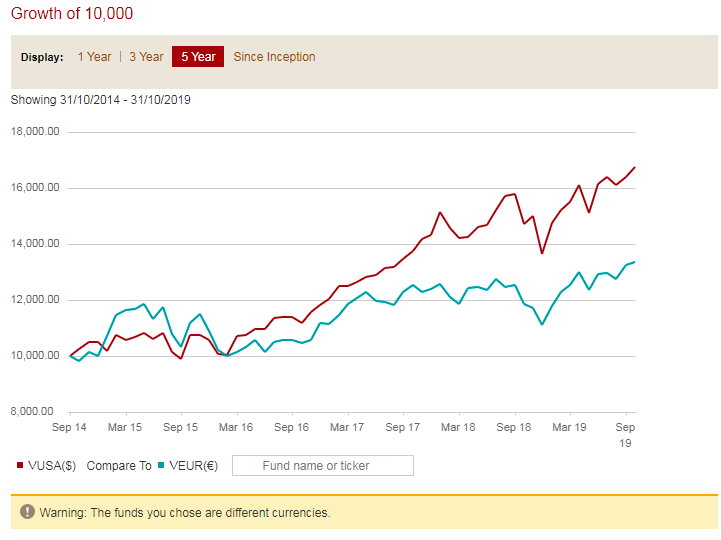

S&P500 versus the largest 600 European companies during the last 5 years. Source: Vanguard ETF Comparison Tool

The American largest businesses have outperformed the European largest businesses during the last 5 years. Note that the funds use different currencies. The graph below shows the Euro/Dollar relation during the last 20 years. You get around 1.05-1.20 dollar for each Euro during 2014-2019. Currency fluctuations between the Dollar and Euro could be ignored if you invest for a longer period. Of course, investments nominated in a different currency can increase or decrease due to currency fluctuations.

Remember, historic performance is no guarantee for the future. John Bogle expected that the S&P500 will provide investors return in the next decade that are lower than the historic returns (read more). Part of this is due to the high market prices in respect to the earnings of the businesses (that means that the earnings yield is low).

Euro/Dollar relation over the last 20 years (macrotrends.net)

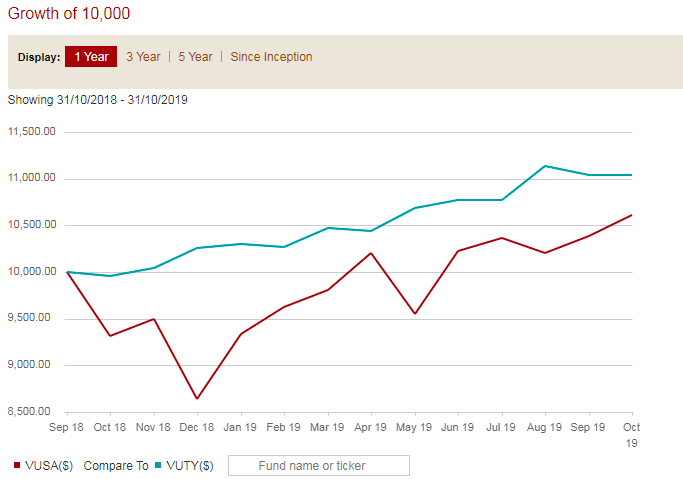

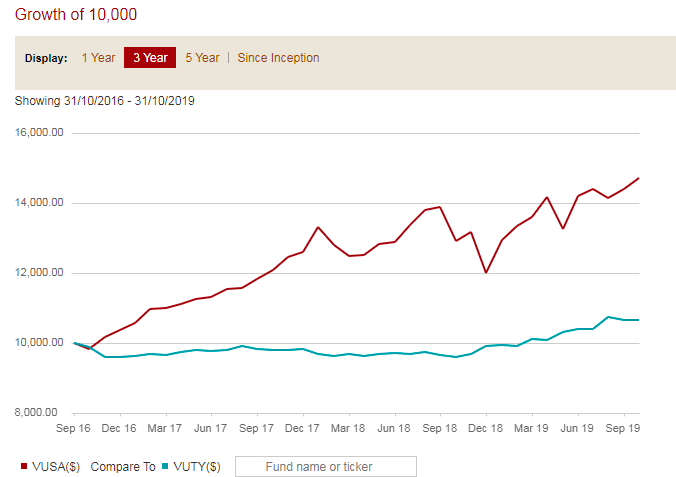

Below you can see how a bond ETF can protect your portfolio during a downturn of the market (like the one of December 2018). But, as seen below, the S&P500 clearly outperforms the bond ETF over a longer period. Investing in stocks and not selling but buying through downturns is the best strategy, if you can handle this mentally.

S&P500 compared with the USA USD Treasury Bond UCITS ETF over 1 year (duration of the bonds is on average 6.5 years) Source: Vanguard ETF Comparison Tool

S&P500 compared with the USA USD Treasury Bond UCITS ETF over 3 years (duration of the bonds is on average 6.5 years) Source: Vanguard ETF Comparison Tool

Beginner's Advice – Some General Thoughts

Here are some important considerations for beginners:

- Make sure you have available cash that you don't need for 5-10 years. Always have enough liquidity to cover your costs for a longer period. This depends on your situation and cost pattern (do you have a family? High rent? Etc.).

- Start with a small amount to get some experience and see how you react when your investment fluctuates in value. Warren Buffett is currently unable to effectively use his $128 billion due to the high prices for businesses compared to their cash flow (read more).

- Start with a small amount given the all-time highs. Although the latest earning reports of companies are looking quite okay, the market's all time high is also driven by (read more) tax cuts, share repurchases and low interest rates.

- A strategy that makes sense for the beginner is to add money each month into the S&P500. This allows you to average into the market over time. This allows you to also take advantage of Mr. Market's prices when they are low (read more about Mr. Market here). Remember, if you invest for the long-run it's best if stock prices go down in the short-run!

Important to know if you manage ETFs yourself (this can't be stressed enough):

- • Discipline to add to your account at regular intervals.

- • Mental strength not to sell during times of panic/recessions.

- • Try to envision a market crash and think about your behavior.

The best advice would be to add (extra) money during recessions and not to sell. Remember that others are going to panic and withdraw large amounts of money from the stock market. This will temporarily decrease the value of your investments by a significant amount. Of course, this means that you can buy companies (or corporate America) at a discount.

Conclusion

Index investing is a strategy that makes much sense to most investors. Never underperforming the market and guaranteeing yourself a good result over time should be very appealing. Stick to high quality Index ETF investing so that you own an underlying index like the S&P500.

This will lead to outperforming most professional investors and banks due to low costs and market performance. All you have to do is believing that the US corporates will earn more in the future. Key for this investing strategy is patience and discipline. Fortunately, you do have brokers that automatically allocate an amount monthly to your index ETF, which could help your long-term success.

Related Articles

- How Warren Buffett Invests in Stocks - Learn about Warren Buffett's investment criteria and philosophy

- How to Get Rich and Build Wealth - Discover timeless financial principles for building wealth