The Investing Principles of Warren Buffett - How to Invest Like a Pro

Willem

The Investing Principles of Warren Buffett

By Willem / Originally published: 9 October 2019 / How to Invest

Table of Contents

Understanding the fundamental investing principles of Warren Buffett will help you to better understand the investing process. This article will present the four principles that are recommended by Warren Buffett. Organizing your investment thoughts around these four principles will help in achieving satisfactory investment results. Furthermore, understanding these four fundamentals will help you to better control your emotions and develop the right investing philosophy.

Mr. Market – How You Should Imagine the Stock Market

The Mr. Market story can be found in what is considered the best investing book "The Intelligent Investor" by Benjamin Graham. It is the book that changed the way Warren Buffett looks at investing. The stock market can be intimidating, and the price fluctuations might scare off (potential) investors. Graham basically tells that an investor should see the stock market as an unstable person (called Mr. Market) who can be very happy or very pessimistic from time to time. The smart thing to do for the intelligent investor is to ignore Mr. Market's behavior most of the time and to take advantage of Mr. Market when low prices are offered.

What is the stock market?

The stock market can be thought of as a large trading market that allows millions of people to buy and sell financial instruments like stocks. The process is highly automated these days. Back in the 17th century, people used to gather at the local marketplace in Amsterdam to trade stocks. Now, you can buy and sell without knowing with whom your trading. The danger in this is that you can be tempted to sell or buy so easy, that you give little thought to making a well analyzed decision. It does however require strong mental discipline to buy during recessions. More on this in the last paragraph about behavior.

How to use the stock market to your advantage

It is key to imagine the stock market as an unstable person who if offering prices (stock quotations) based upon his mood. If Mr. Market is very pessimistic (e.g. during a crisis), he can offer stocks for prices far below what a company should be worth (calculated for example by looking at the cash a company generates). The good news is that you can determine when you buy or sell a stock. You do not have to buy or sell simply because Mr. Market offers you a certain price. It is totally fine to ignore Mr. Market for most of the time, and only act when Mr. Market is very pessimistic. Warren Buffett often refers to this as waiting for the right pitch. That is, the right price for a stock.

The Mr. Market principle is still very helpful to Warren Buffett

Mr. Market is your servant, not your master. You can determine when to deal with him. It is a huge advantage if you can imagine the stock market as your servant and keep a rational view on the market. As Warren Buffett often states: "be greedy when others are fearful, and fearful when others are greedy". This means buying good companies when they are cheap due to negative market sentiment. And this is much easier during a recession or downturn of the market.

Market fear and overselling

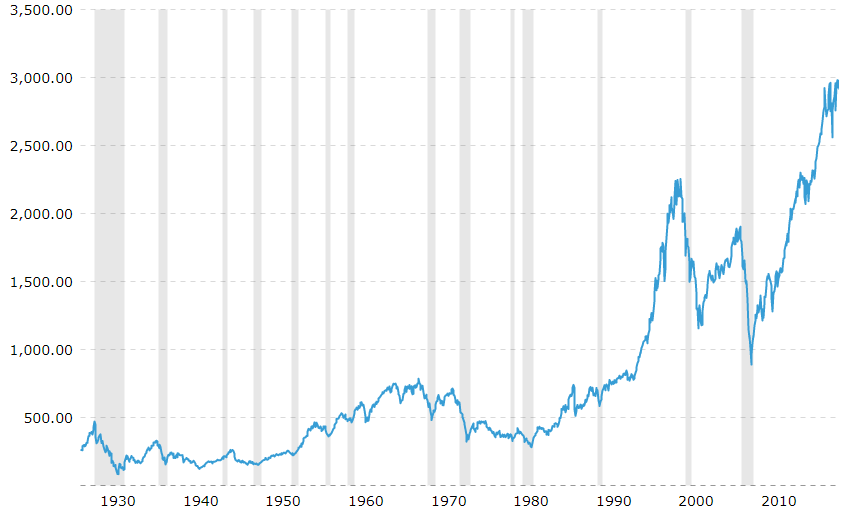

Fear in the market leads to overselling reactions due to mass panicking. Strong declines can also trigger margin calls. Buying on the margin means buying stocks with borrowed money. If the value of the stocks drops below a certain threshold, then the bank can demand that you either sell stocks or provide more funding. Automated trading can strongly increase the volatility of the market. The declines can be seen in the figure of the S&P 500 (the largest 500 companies of the USA) below.

Figure of the S&P 500 (inflation adjusted) with recessions (latest recession was December 2007 – June 2009) (source: macrotrends.net).

Recessions are a normal part of the economic business cycle

The graph shows a couple of steep declines of the S&P 500 (recessions). This provides excellent buying opportunities to investors, as stocks decline in value. Also, the price of stocks of excellent businesses. As seen in the graph, recessions are not uncommon over the years. Warren Buffett describes the right attitude towards the market in his letter to shareholders of 1987. Mr. Market provides you with daily quotations. The quotations can fluctuate widely, even though the stock is of a terrific business with stable economic characteristics. You have the luxurious position to ignore Mr. Market for most of the time. Until he offers you bargain prices of course for great businesses!

Stay objective and use recessions to your advantage

This means that you need to understand the value of the business and compare it to the prices that are offered to you. Not the market, but the operating results of the company determine the success of an investment. Of course, Mr. Market can ignore the facts for quite some time (potentially years). The good news is that this gives you more time to buy stocks at a price below the intrinsic value of a company. In the end, the price of the stock will follow the economic success (earnings).

Stocks are Businesses

Behind the ticker symbol (e.g. AAPL for Apple, or GE for General Electric) of the stock is an actual company. That means a group of people with a common goal that creates value for their customers. The best company is one that generates more money each year without spending much money. Excellent companies also have high returns on invested capital (if they spent a dollar, they receive more than a dollar back). A bad business spends a lot of money and does not generate enough money to cover its costs.

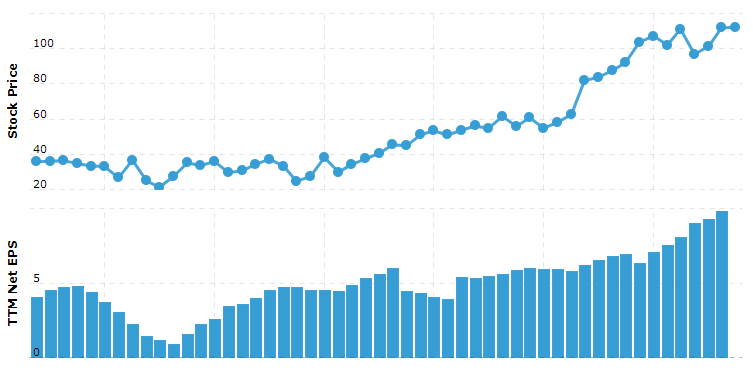

Simply put, the price of a stock will follow the earnings over the years. In the short run however, prices can fluctuate largely. As Benjamin Graham once said: the stock market is a voting machine in the short run, but a weighting machine in the long run. That means that the market will value the stock correctly if the short-term panic is over and the earnings are recognized. Stocks that consistently produce more cash for shareholders will rise over time.

Figure of JPMorgan Chase 2006-2019 with a clear association between earnings per share (EPS) and price Source: www.macrotrends.net

The best test to see if you are investing

Warren Buffett explains that the best test of seeing whether you're investing is if you care if the stock market is open. If you bought a great business with increasing earnings, then you can ignore the daily quotations for years. Because you know that the value of the business will increase due to its superior performance and management. This is in strong contrast to the attitude of most investors, who just focus on the next year or two. This is also why it is so important to buy a business that you fully understand and want to hold indefinitely. Warren Buffett once said that if you buy Berkshire Hathaway, then you should want to own it for at least 5 years.

For now, it is important to see a stock as a business. It is essential that you understand what the business does, how much it is earning and how much it will earn in the future. So, you do want to read the annual report and look at the financials of the last 10 years at least. The annual report should tell you what a company is worth, if it can pay its obligations and if the management is doing a good job. More on this in later articles.

Margin of Safety – Always Leave Room for Error

The margin of safety is determined by the price that is paid for an investment compared to the value of the investment. For instance, you figure out the value of a stock and buy it with a substantial discount from that price. This leads to less risk, and a higher return. Less risk of losing money and overpaying, and higher returns due to the low entry point. Imagine an elevator that should be able to carry 10 people. You probably want to design the elevator in such a way that it can carry at least 15 people. This gives you some slack in case of an error in your calculation.

The story is very similar when you value a business. If you believe that a company is worth one billion dollars, and you buy it for a billion, then you have no room left for errors in your calculation. Buying the company for 700 million dollars would leave room for error if the company turns out to be worth only 900 million for instance.

Applying the margin of safety

Successful investing comes down to figuring out what something is worth and paying less for it (as stated by Joel Greenblatt, another famous investor). Your task as an investor is to figure out how much cash a company will produce during its lifetime. The coupons (pay-outs) of a bond are printed on the bond. It is relatively easy to determine the value of the money that you will receive from a bond in the future. If you have a $1000 bond with a 5 percent interest rate, you will earn $50 (the coupon) per year (with a yearly pay-out).

The cash that a company will produce is much harder to predict. This is one of the reasons why Warren Buffett likes stable and consistent companies. This makes it easier to predict how the earnings will progress over time. Determining the value of future cash flows is done by a method called discounted cash flows (DCF). The investor needs to figure out how much money he will receive, when and with what certainty.

The good thing about lower prices

Buying stocks on sale can help in getting a better margin of safety. Many people are disappointed when prices go down. But love it when other products (groceries, cars or cloths) are on sales. The trick of course, is to make very sure you are buying a good company. But all things equal, lower prices mean more safety and a higher return. Of course, the reverse is true during extreme boom markets like the one in 1999. Companies with no income (or very little income) traded at a ridiculously high multiple to earnings (the share price is determined by the company's earnings divided over the outstanding shares of the company, multiplied by a multiple). A high multiple to earnings can sometimes be explained due to exceptional growth opportunities of a company, superb management and for instance a sound financial position (low debt). But, often a very high multiple to earnings means high prices and virtually no margin of safety.

As Graham states in his book The Intelligent Investor:

"By refusing to pay too much for an investment, you minimize the chances that your wealth will ever disappear or suddenly be destroyed."

The importance of the margin of safety is also described in the book of Seth Klarman (the book is called Margin of Safety). Klarman is a very successful value investor. He states that:

"A margin of safety is achieved when securities are purchased at prices sufficiently below underlying value to allow for human error, bad luck, or extreme volatility in a complex, unpredictable, and rapidly changing world."

In sum, you limit your chances of loosing money by paying a lower price than the value of an asset (e.g. a company). Furthermore, you earn more if prices rise from your low entering point. This requires enormous mental strength and patience. Something we will discuss in the next section. The margin of safety also relates directly to the most important rule of Warren Buffett: "not losing money". Investing with a margin of safety is the big secret to superb investing results!

Your Own Behavior

The required emotional discipline should not be underestimated if one wants to be a successful investor. To beat the crowd, you need to act different from the crowd. This includes investing in companies that might be out of favor or investing during times when the market is panicking. Lots of people will tell you that the stock market is dangerous during recessions, but safe during booms. By now, you should realize that the opposite is true! Hence, your temperament and behavior are key to investing success.

John Maynard Keynes (a famous British economist) wrote a classic book in 1936 called "The General Theory of Employment, Interest and Money". Buffett revered especially to chapter 12 of this book, called "The State of Long-term Expectation". Keynes was also a successful investor. He figured out that timing the market was not a good idea and started to concentrate his investments on companies he understood with good management (Warren Buffett also concentrates on a few very good businesses that he understands and wants to keep these businesses indefinitely).

The old investing principles are still relevant

It's staggering to see that the wisdom found in books of the 1930's is still so relevant. Keynes explains that forecasts depend on the confidence of the likelihood of making a sound investing prediction. If you value a stock, you basically need to determine how much money a company will produce, when, and how certain you are about your reasoning. Day-to-day fluctuations can excessively influence the market's view on the future. Human nature is inclined towards getting results (money) quickly. Keynes furthermore explains that investing requires behavior that can be described as eccentric and unconventional in the eyes of the market.

This means that great investors like Warren Buffett often make choices that are not popular in the eyes of the crowd. Under performing in the short run is very likely and something that must be thought about upfront by the investor. That's why you need to develop a long term perspective. Price estimations can differ largely based on daily fluctuations. The individual investor has a huge advantage if he or she is mentally able to ignore the noise and hold on to his businesses. It is just common sense that human behavior plays a large role, as we are not able to predict the future purely with mathematical models.

What you can do with these principles

So, think for yourself! You are right because of your analysis and facts, not because someone else agrees or disagrees with you. Always do your homework and research the companies you want to buy. People lose money over time often due to "a tip from an expert", high costs and/or their own behavior (buying high, selling low). It is very likely that you will do worse with your stock picks than the market for a while.

This makes perfect sense, how are you going to beat the herd if you act like them? Get to the mental stage, where you love it if stock prices drop. This takes more effort and training than you might think! Just look at the news to see how the moods of investors can change overnight. But never forget that in the long-run a sound investment in a business with increasing operating earnings will be rewarded.

Summary

Warren Buffett once said that you only need to understand chapter 8 and 20 of the Intelligent Investor and Chapter 12 of The General Theory by Keynes Forbes article. Fortunately, these are the investing principles of Warren Buffett that are discussed in this article. You will have a huge advantage if you understand and adhere to this investing philosophy. It should be noticed that it will take time and practice to fully comprehend these principals!

It is difficult to have the emotional discipline to take advantage of irrationalities in the market. As Seth Klarman said about investing in his book (which is similar to the view of Warren Buffett):

"The hard part is discipline, patience, and judgment. Investors need discipline to avoid the many unattractive pitches that are thrown, patience to wait for the right pitch, and judgment to know when it is time to swing."

In The Snowball (a book about the life of Warren Buffett) you can read how Buffett was often reading and searching for investing opportunities. He waits patiently until good companies can be bought at the right price. If you can stay objective, detach yourself from the crowd and don't get fearful when others get fearful, then you can become very rich. This requires a good temperament, which is more important than a high IQ.

In sum, the investing principles of Warren Buffett are:

1. Your attitude towards stocks and thinking of stocks as businesses

2. Always use a margin of safety to leave room for error

3. Use Mr. Market to your advantage, not as your guide

4. Control your emotions and stick to your own research, logic and reasoning

The key to success in investing according to Warren Buffett is:

"In my opinion, investment success will not be produced by arcane formulae, computer programs or signals flashed by the price behavior of stocks and markets. Rather an investor will succeed by coupling good business judgment with an ability to insulate his thoughts and behavior from the super-contagious emotions that swirl about the marketplace" (1987 Letter To Shareholders).

Related Articles

- How Warren Buffett Invests in Stocks - Learn about the specific criteria Warren Buffett uses to select investments

- A Bird in the Hand is Worth Two in the Bush - Understanding time value and investment decisions

- How to Create an Investment Expectation - Classifying stocks into categories to develop realistic investment expectations