How to Create an Investment Expectation - A Guide to Stock Categories

Willem

How to Create an Investment Expectation

By Willem / Originally published: 14 October 2019 / How to Invest

Table of Contents

The best strategy for most investors is to buy a very good business at a fair price like Warren Buffett. This should deliver steady investment returns over time. However, there are more investing strategies that can deliver good investment returns. It is key to think up-front about the investment expectations before buying a stock.

This article discusses 6 categories that can be used to classify stocks and its investment expectations. Furthermore, we look at the most essential "need-to-know" per category. The categories can be found in the book of Peter Lynch – One Up on Wall Street. Peter Lynch was a very successful investor and his book is one of the best reads for investors. Understanding the situation of the company and forming an investing story will help in managing your investment expectations.

Each category has its own characteristics, risks, and potential rewards. Understanding these categories will help you develop realistic investment expectations and make more informed investment decisions.

The Slow Growers

Slow growers are often large companies that grow around 3 percent per year. Peter Lynch mentions that he does not have a lot of slow growers in his portfolio. Slow growers have low earnings growth which means that the stock price tends to increase slowly as well.

The utility industry is a good example of this class. The electric utilities used to grow fast in the 1950's and 1960's, but growth cannot go on forever. Finding new growth opportunities can be simply too expensive or difficult when a company reaches a certain level of maturity. So, slow growers tend to pay steady and good dividends, which makes them attractive to the more conservative investor.

What you need to know about slow growers

The main reason for buying slow growers is the dividend. Hence, checking the dividend history, debt, pay-out ratio, earnings and cash-flow stability is crucial. Low debt means less interest payments. A low pay-out ratio means that there is room to raise dividends, or still pay them if the earnings go down.

Don't only look at the current year but track the financial performance over 10 years to make sure that the earnings have covered the dividends. Searching for companies with a 10 to 20+ year history of increasing dividends can be a good starting point.

One final thought for utilities is that their prices are often regulated by the government. So, during high inflationary periods, it might be hard to raise prices enough to cover the inflation.

Stalwarts

This category is most like the stable companies that Warren Buffett likes. Stalwarts are stable and well-established companies that still offer long-term growth. Think about a company like Procter and Gamble or Coca-Cola. They sell products and services with continuous demand.

The companies in this category still have an earnings growth of approximately 10-12 percent per year. On top, they have strong cash-flows and balance sheets. The chance of a bankruptcy for this category is very low and the recovery period is fast after a crisis.

What you need to know about stalwarts

The buying price is important if you want to make a sizable profit with a Stalwart. Sometimes, well-established companies have temporary set-backs due to a business problem or lawsuit that can be solved over time. This can offer an attractive entry point.

Checking the future earning potential is also a good idea before investing in Stalwarts. Is the business likely to continue its steady earning pattern? Furthermore, investigating potential underperforming acquisitions can help to prevent future earnings decreases.

Fast Growers

This category consists of fast-growing companies. They grow with at least 20-25 percent per year. The chances for making large profits are high in this category.

An example is Marriott or McDonald's. These companies developed business models that could be leveraged to other countries and areas. The expansion led to increased earnings and stock prices. Other examples of fast growers are Amazon and Alibaba who take advantage of the growing ecommerce possibilities.

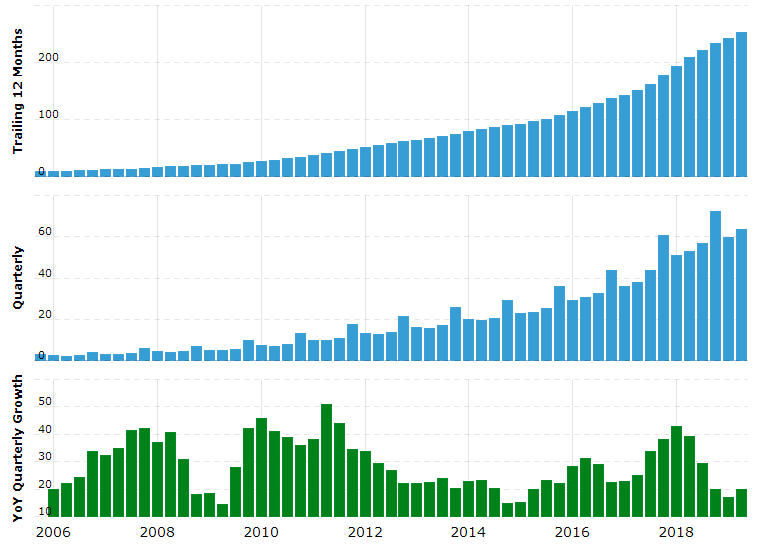

Source: macrotrends.net

What you need to know about fast growers

Growth costs a lot of money (for instance building new hotels or restaurants). Therefore, a good balance sheet and adequate financial resources is crucial. Also, if the growth is slowing down then the share price is likely to drop as well.

Another important point to realize is that growth must be sustainable. Growing at 50 percent a year is not likely to continue for years. 20-25 percent is more sustainable. Growing for longer periods at this rate is possible if you are convinced that the proven expending of the business model works. So, do not overpay for growth that is not likely to continue long. Peter Lynch mentions that a rule of thumb could be paying a P/E multiple close to the sustainable growth rate.

Sometimes a business model only seems to work in a specific country or area, which limits the future growth opportunities. Additionally, it is smart to check at what speed new locations of the company are opened. Is this increasing or decreasing compared to last year?

Cyclicals

Cyclical companies face expanding and contracting profits and earnings based on the business cycle. Examples are car manufacturers, airlines, the steel industry and chip producers (semiconductors). Cyclical companies can fall fast but can also rise in a short amount of time when the economy recovers.

What you need to know about Cyclicals

Understanding the industry is crucial to determine when these stocks bottom. P/E ratios tend to be low and 'attractive' at the end of a cycle of e.g. car manufactures or chip producers. This 'attractive' low P/E can be misleading due to current earnings and future expectations. It can take a long time before you make back your money if you buy a cyclical stock at the peak of a cycle.

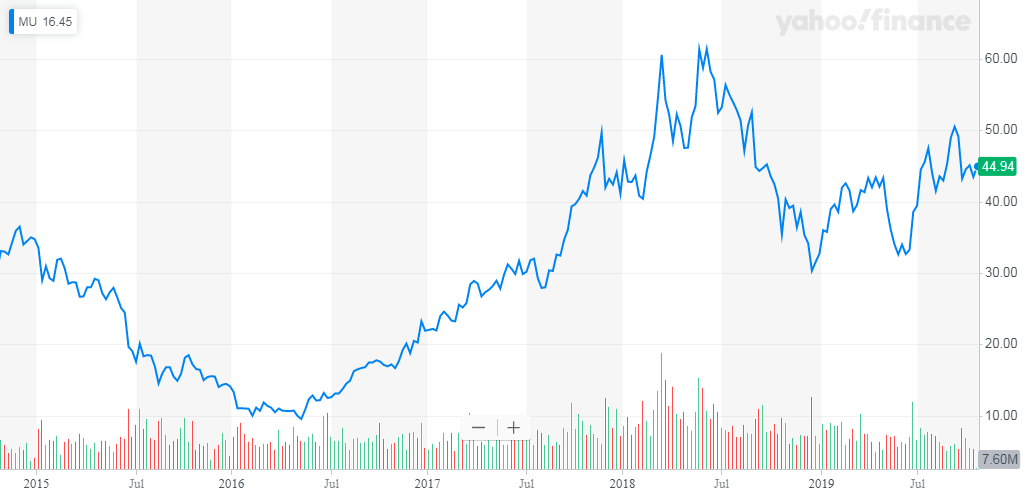

The earnings of the latest quarter do not yet reflect the negative downturn, which is captured in the lower stock price (the lower expectation of the market). That is why you get a low P/E. Looking at the forward P/E can help in this case, as this will be higher if earnings are anticipated to drop. On the other hand, much money can be made by buying chips at the bottom of the cycle (semiconductors like Micron Technology). A strong balance sheet with low debt and enough cash to survive temporary downturns are imperative.

Source: finance.yahoo.com

Inventories of the business is also an important metric to check. Inventories that are increasing (this can be found on the balance sheet) can be a negative sign as the reason could be decreasing demand. Specific industry knowledge is useful in order to predict the business cycles.

Turnarounds

This category consists of companies that got into financial troubles and need to work hard to become healthy again. General Electric (GE) is an example of a current turnaround. Another example is Apple. Fortunately, Apple had enough cash, was able to cut costs and developed attractive products.

A cyclical stock like the car manufacturer Chrysler also became a turnaround after it went down too far in the cycle. Fortunately, turnarounds can be very profitable if you understand what your doing. Turnarounds are less dependent on the market than the other categories. Business improvements mostly determine the stock price.

What you need to know about turnarounds

The worst thing that can happen is that a turnaround is not able to recover and is not saved by the government (like Lockheed for example). Therefore, you need to check if there is enough cash available to pay creditors until the recovery succeeds. Debt is what leads to bankruptcies. So, make sure the company can handle its debt. Putting turnarounds or your watchlist is not a bad idea. This gives you time to study them, to read the reports and to see if the situation of the company is improving. This can significantly lower the changes of buying a potential bankruptcy.

Additionally, strong management (with a proven track-record) and insider-buying can increase the confidence in a successful turnaround. Reading the turnaround plan and tracking the quarterly reported progression and promises is also essential. Are the costs going down? Are the margins improving? Are the sales increasing?

Asset Plays

The last category are asset plays. These companies have a valuable asset that is worth more than the current share price. An example is cash, or a patent, real estate, bonds and stocks.

What you need to know about Asset Plays

Correctly valuing the asset is crucial. Additionally, you need patience to wait until the value of the asset is recognized by the market. Sometimes large shareholders try to unlock the value of the assets which can help speed up stock price increases. Lastly, it is important to know if the value of the asset can change over time. If it is decreasing, you might not have enough time. Also, increasing debt can hamper the value of the assets as creditors need to be repaid first.

Use the categories to form fair investment expectations

Before investing, make sure that you can put your stock in the right investing class. This will help to develop a reasonable investment expectation for your stock. For example, if your stock is a turnaround, then you should be able to explain how the company got there, and how the company will improve again. Is there a good manager who's buying the stock? Are there signs of earning increases and cost cuttings? What will be the timeline for the recovery?

Your investment story will be even better if you know the financial ratio's, debt, cash-flow and return on capital for example. If you don't know the category and cannot form an investment story for a stock, then it might be a good idea to examine another potential investment!

Remember that companies can move from one category to another over time. Fast growers can become stalwarts or slow growers over time.

Knowing the stock categories will help in determining the right expectations. For most of us, having a lot of good, understandable and steady companies (Stalwarts) is likely to be a good thing. Having around 75% of your money in companies like Apple, Coca-Cola, P&G and JPMorgan will help to have steady investment increases over time. Adding more cyclicals and turnarounds is likely to increase the volatility of your stock portfolio.

Related Articles

- How Warren Buffett Invests in Stocks - Learn about Warren Buffett's investment criteria and philosophy

- The Bird in Hand Theory - Understanding dividend investing and its importance