The Importance of Understanding Investment Risk - Academic vs. Warren Buffett's View

Willem

The Importance of Understanding Investment Risk

By Willem / How to Invest

Table of Contents

- 1. Why is Investment Risk Important?

- 2. Academic Investment Risk

- 3. The CAPM Model: The Importance of Beta in Finance

- 4. Investment Risk According to Warren Buffett

- 5. Investment Risk Related to Your Investment Horizon

- 6. Focus on Great Businesses to Decrease Investment Risk

- 7. The Importance of Defining Investment Risk Correctly

Investment risk is commonly understood in terms of volatility in the world of Finance (read more about volatility risk). This academic definition of investment risk is fundamentally different from the view of Warren Buffett on risk. This article discusses the differences in these viewpoints on investment risks and explains why it is essential to understand investment risk correctly.

Why is Investment Risk Important?

Investing and risk are often jointly mentioned when people talk about investing. Generally, investing is frequently seen as risky but can be very rewarding as well. I believe that this view of risk can change when one better understands investment risk.

Understanding investment risk correctly will help to build a portfolio that increases the chances of increasing your wealth over time. Additionally, it will help to control your own behavior when you can understand your investment risks. Investing will be more fun if you understand risk and how to maximize the chances of investment success.

Hence, the importance of having a good definition of investment risk. First, we'll look at the academic risk definition and then we describe investment risk as viewed by Warren Buffett.

Academic Investment Risk

Finance mostly defines investment risk of an asset by looking at its volatility. Volatility is simply said the movements of the price of an asset (e.g. a stock) in comparison to the market (e.g. S&P 500). A stock is more volatile if its price swings further from the mean of the stock market. Finance theory argues that a stock that has larger ups and downs than the market is riskier due to unpredictability.

Finance professionals often measure the risk (volatility) by 'beta'. The beta of a stock is 1 if it moves completely along with the prices of the market. If the beta is 2, then a stock would go up 2% if the market would increase by 1%. A stock with a beta lower than 1 is seen as less risky than the market. Adding such a low beta stock would decrease the risk of your portfolio in respect to the market.

The CAPM Model: The Importance of the Beta in Finance

Let's look at an application of the beta in Finance. The beta is part of a calculation that is called the CAPM (capital asset pricing model learn more about CAPM) which is used to measure the expected return of an asset.

The CAPM model: ERi = Rf + βi (ERm − Rf):

- • ERi = expected return of investment

- • Rf = risk-free rate (e.g. a long-term Treasury bond)

- • βi = beta of the investment (the volatility of the asset)

- • (ERm − Rf) = market risk premium (the return of the market minus the Treasury bond)

The link above explains the CAPM model in more detail. But for now, it is enough to understand that if the beta (volatility) is higher, then the required return from the asset must be higher as well (ERi is higher if the beta is higher). That is, investors want a higher return for a riskier investment.

Remember, there is always market risk (the risk of e.g. the S&P 500, which has a beta of 1).

The CAPM expected investment return (ERi) is used as the discount rate to determine what the future cash flows of a business are worth today. If the ERi is higher (meaning the stock is seen as riskier) then the discount factor will be larger. So, the cash flows of the future in that case are worth less today because investors perceive these cash flows as riskier.

Luckily, Warren Buffett states that it might be best if you know nothing about beta and CAPM when you invest. The underlying assumptions of the academic definition of investment risk like an efficient stock market and rational investors are not correct. Also, reducing risk is done by diversification according to these Finance theories. But as we will see, Warren Buffett thinks that concentrating in great businesses will decrease risk.

Investment Risk According to Warren Buffett

A more logical approach to risk than the academic view is in my opinion the one of Warren Buffett. He defines risk as: "the possibility of harm or injury" (Source: The Warren Buffett Portfolio by Robert Hagstrom).

According to Buffett, an investment is riskier if there is a high chance that you will lose money over time. The probability of losing money is determined mostly by the quality of the business, the price and your own behavior (how Warren Buffett invests in stocks). Risk comes from not knowing what you're doing. Hence, the need to fully understand the investment and chances of success.

Business risk can arise from the capital structure (too much debt), the nature of the business (long lead time and heavy capital requirements), risk of overpaying or bad management for example.

Warren Buffett shared his view on risk in his letter to shareholders of 2011:

"The riskiness of an investment is not measured by beta (a Wall Street term encompassing volatility and often used in measuring risk) but rather by the probability – the reasoned probability – of that investment causing its owner a loss of purchasing-power over his contemplated holding period. Assets can fluctuate greatly in price and not be risky as long as they are reasonably certain to deliver increased purchasing power over their holding period."

Notice the importance of probability. Warren Buffett always incorporates the chances of losing money and buys big when there is a high likelihood to win. The latter will occur if a good business is cheap (high certainty of large future cash flows compared to the price you pay). A stock that drops significantly is seen as risky due to the higher beta in academia.

But Warren Buffett sees a stock as less risky if its price drops. Especially when you buy an outstanding business with good management for a lower price. This decreases your risk of losing and increases your returns.

Another interesting insight is to realize that a beta of 0 does not mean no risk. Holding currency over time is risky due to inflation (how to get rich and build wealth), even though the beta is zero according to Buffett.

Investment Risk is Related to Your Investment Horizon

The time you hold an investment will also influence the risk. There is a high certainty that a couple of very good businesses will produce profits in the future. Buying Coca-Cola at a reasonable price and keeping it for 10 years will produce almost no risk according to Warren Buffett's way of thinking. Holding Coca-Cola for a week can be very risky as the market can react very irrationally in the short run! Hence, the necessity to have a long-term horizon (years) to reduce risk of losing money.

Buffett's four primary risk factors:

- 1. The certainty with which the long-term economic characteristics of the business can be evaluated.

- 2. The certainty with which management can be evaluated, both as to its ability to realize the full potential of the business and to wisely employ its cash flows.

- 3. The certainty with which management can be counted on to channel the rewards from the business to the shareholders rather than to itself.

- 4. The purchase price of the business.

(Source: The Warren Buffett Portfolio by Robert Hagstrom read more about The Warren Buffett Way)

Focus on Great Businesses to Decrease Investment Risk

You can significantly increase the chances of market outperformance by concentrating your money in superb businesses. Unfortunately, the probability of underperforming the market by a significant amount is also higher if you concentrate your money in bad businesses! So, it is very risky to concentrate your portfolio in bad businesses. Therefore, buy Index funds if you are unable to do value business or likely to lose control over your emotions (an introduction to ETF index investing).

Don't forget, market fluctuations can negatively influence your investing behavior by selling at the wrong time.

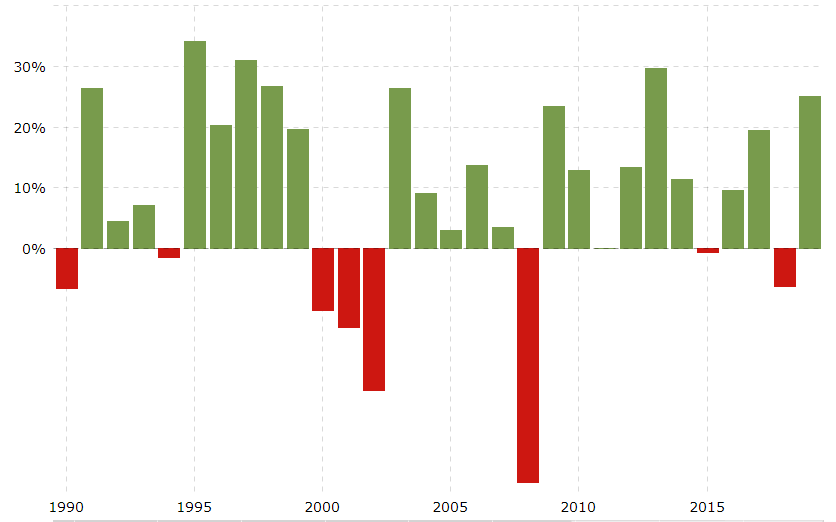

Market returns fluctuate (Source: S&P 500 Historical Annual Returns)

Important that You Define Investment Risk Correctly

Investment risk comes from the quality of businesses and the price that you pay. The lower the price for a good business, the lower the risk. Concentrating your bets on excellent businesses will increase your chances of outperforming the market over time and will decrease risk.

The biggest risk is in the investor him- or herself (your behavior the investing principles of Warren Buffett). Even the best investors (Charlie Munger, Warren Buffett and Keynes for example) have years in which they underperform the market. Trusting your judgment and the quality of your businesses, combined with a long-term mindset (at least 5 to 10 years) will help to stay rational when others become fearful.

Focusing on short term performance is extremely risky, even if you invest in superb businesses like Berkshire Hathaway. No one knows how the market will react the next week or in the next year. This could mean decreasing prices for even the best stocks. Fortunately, in the long run the market assigns a value to a stock that rightly reflects the economic prospects of the business.

If you're worried about the risk for your company, then it might be a good idea to think twice about investing in that company. Always think about the expectations (how to create an investment expectation) of your investments before you invest.

Related Articles

- How Warren Buffett Invests in Stocks - Learn about Warren Buffett's investment criteria and philosophy

- An Introduction to ETF Index Investing - Discover why Warren Buffett recommends index funds for most investors

- The Investing Principles of Warren Buffett - Understand the key principles behind Warren Buffett's investment success