How to Value a Stock with DCF Analysis - A Guide to Intrinsic Value

Willem

How to Value a Stock with DCF Analysis

By Willem / Originally published: 20 November 2021 / Financial Analysis

Table of Contents

- 1. Introduction

- 2. Warren Buffett on Intrinsic Value

- 3. What is a DCF Analysis?

- 4. DCF Stock Value Example

- 5. 1. Starting Cash Flow

- 6. 2. Growth Rate

- 7. 3. Discounting and the Time Value of Money

- 8. Warren Buffett and His Discounting Rate

- 9. Selecting an Appropriate Discount Rate

- 10. 4. Determining the Terminal Value

- 11. Stock Value is a Range, Not an Exact Number

- 12. DCF Should Be Used Conservatively

- 13. Conclusion

Introduction

Determining a stock's value is most accurate when using a DCF analysis. The method is rather simple, but the reasoning behind the assumptions is crucial to avoid investing mistakes. In this article, we'll explore how to perform a DCF analysis and what factors to consider when valuing a stock.

Warren Buffett on Intrinsic Value

"Intrinsic value is an all-important concept that offers the only logical approach to evaluating the relative attractiveness of investments and businesses. Intrinsic value can be defined simply: It is the discounted value of the cash that can be taken out of a business during its remaining life."

Source: Berkshire Hathaway Annual Report – Owner's Manual, 2002

The value derived from DCF analysis is called the present value or intrinsic value. This represents the value today of the future cash flows that an investor will receive. For an easier way to think about discounting and what a business is worth, see this article on the time value of money.

What is a DCF Analysis?

DCF means discounted cash flow analysis. Essentially, this involves figuring out the cash flows that an asset will produce (for example, over the next 10 years) and then discounting them back to determine the value of these cash flows today. Discounting is simply dividing the cash flows by a certain percentage. We do this because we expect a specific return on our money.

The value of the DCF is the price you need to pay for the stock to receive a return of, for example, 15% (if that's your discount factor) to achieve your required rate of return. Obviously, this assumes that the assumptions of your DCF hold over time. A stable business will increase these chances (see how Warren Buffett invests in stocks). The investor's task is to figure out the cash flows of the stock and the certainty of these cash flows.

Valuing a stock is mostly done via DCF or multiples (see stock valuation using P/E multiples). You could also simply look at the book value, but the value of a stock is determined by what the assets will earn over time, not by the book value (see book value and intrinsic value).

DCF is used to determine how much the cash that a business will produce in the future is worth today. The input (assumptions) for a DCF are:

- 1. The current free cash flow

- 2. The growth rate

- 3. The discount rate

- 4. A multiple to determine the terminal value (i.e., the stock price in, for example, 10 years)

DCF Stock Value Example

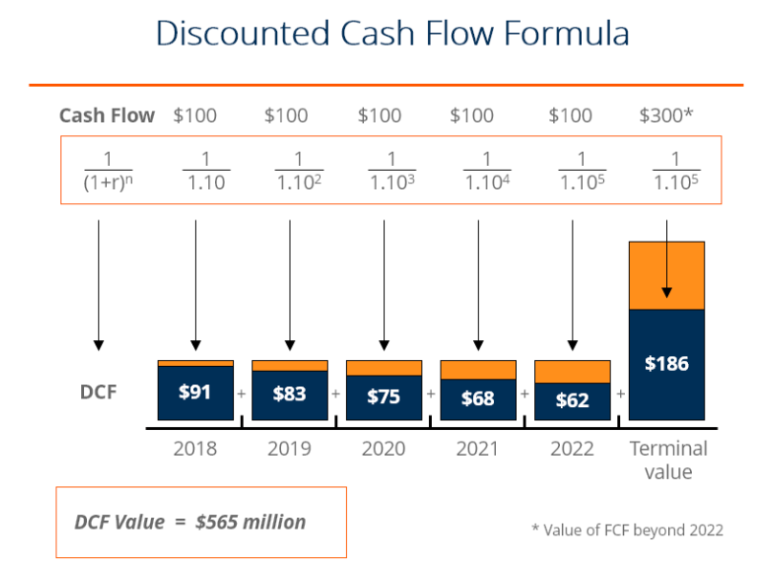

The figure below shows the discounted cash flow formula. You simply divide the cash flows by the discount factor (the 1/(1+r)^n) and then add all these numbers up. The blue part shows that the value of the cash flow is lower in the future; this is due to discounting. That is, $100 million today is worth more than getting $100 million in 4 years (see time value of money below).

The terminal value is the expected value of the company in the future. This is often determined by multiplying the cash flow by a multiple (e.g., the P/E or P/Cash Flow multiple). The example shows a static cash flow, so no growth is assumed over the years.

Source: Corporate Finance Institute

1. Starting Cash Flow

The starting cash flow is basically the free cash flow (learn more about FCF) that you can find on the statement of cash flows. You can use the free cash flow of the company or the free cash flow per share. This represents the earnings of the business that we will let grow and then discount to determine what the business is worth today.

The following articles provide more information:

- How to determine free cash flow by examining Apple: Warren Buffett and Owner Earnings

- The importance of cash flow: Free Cash Flow versus EBITDA

2. Growth Rate

After establishing the cash flow, you need to think about its growth. The higher the growth, the higher the future cash flows. It's essential to be conservative here and look at the last 10 years and 5 years to determine the growth rate and whether it's slowing down or increasing. It can also help to consider what analysts think about future growth. Ideally, your specific knowledge will determine how fast the business will grow.

The moat (competitive advantage) will determine the certainty we can have in the future growth of a business. It's helpful to create scenarios of neutral, positive, and low growth based on your estimations. Changing the growth rate and terminal value P/E multiple is also called sensitivity testing. This allows you to see how different scenarios will influence future cash flows.

Growth is also related to the incremental returns on capital that a business can achieve. This deserves more attention, but in short, the best business is one that can deploy its incremental capital consistently at high rates of return as long as possible (see Berkshire Hathaway's 1992 letter).

If a business becomes more mature (e.g., McDonald's), the company will return capital to shareholders in the form of dividends and/or share buybacks. While this is appreciated by most investors, it would be preferable if all the capital (incremental or additional) is reinvested at high returns. Ideally, you want McDonald's to invest its capital to operate more restaurants that earn, for example, 20-30% returns on capital instead of paying out capital in the form of a dividend that is taxed.

3. Discounting and the Time Value of Money

Cash that you will receive in the future is worth less today than in a year. This is due to the opportunity you have to invest the money. You can always put your money into a bank account or government bond to get a safe return. Treasury bonds and your savings account will provide you with an almost guaranteed interest percentage. Investing in stocks or other assets means giving up this 'guaranteed' return for a more uncertain return. Learn more about the time value of money.

Low bond yields today offer investors less opportunity for a safe return. So, investors are more inclined toward investing and putting their money into stocks or other assets. If bonds offered a 10 percent yield, many more investors would prefer this safe option. This is an important reason why stock prices are so high (because bond yields are very low).

Why We Need Discounting

Discounting is used to determine the value today of a future cash flow. Learn more about the concept of discounting.

In finance, you learn that the appropriate discount rate is the WACC (weighted average cost of capital, learn more about WACC). The WACC tells you the costs that a company pays on its debt (interest) and equity (required return for shareholders). You discount with the WACC to ensure that the return of the cash flow is higher than the costs of debt and equity (see understanding investment risk).

The WACC uses beta for risk (which measures volatility of the stock compared to the market) to determine the equity return. Warren Buffett does not believe in this method. High returns on capital and the one-dollar rule (if you invest one dollar in the business, it should generate more than a dollar of market value over time) ensure that the business is earning more than the costs of debt and equity.

Warren Buffett and His Discounting Rate

Warren Buffett uses the treasury long-term bond rate for discounting. He discounts with the bond rate to compare the cash flow of a stock to the treasury yield. Another way to think of it is in terms of required rate of return. The more return you want, the higher the discount rate. This means that the net present value will be lower because the denominator is higher with a high discount rate. You're essentially saying that you value money today a lot and want a high return for investing your money.

Of course, discounting with high discount rates can turn out to be too conservative. In sum, discounting is dividing the cash flow by the discount factor (e.g., 10% as in the figure above). Discounting thus reduces the future value of the cash flow to account for the fact that a dollar today is worth more than a dollar in the future. Current bond yields and the investor's own preferences will mostly determine how much future cash flows are worth.

Selecting an Appropriate Discount Rate

The discount rate determines your desired return. It is the return that would make the investor indifferent between the present and future value. So, the discount factor corrects the future cash that the business will earn for other investment opportunities (Treasury Bond). Often, an additional component is added to the Treasury return (yield) to increase the margin of safety, as you don't want to discount the future cash flow at a rate that is too low, which would lead to overvaluation.

A useful rule of thumb: the more uncertainty about future cash flows, the higher the discount rate should be. In times of low interest rates (as was the case in 2020), it's safer to prepare for higher interest rates in the future by applying a higher discount rate. This is especially important when many companies trade at high multiples to earnings (more on multiples and how they are determined: stock valuation using P/E multiples).

In general, excellent companies like Coca-Cola and Johnson & Johnson could be discounted at a lower rate than uncertain businesses. This is because their future cash flows are more predictable. The DCF will be most accurate in these cases. A restructuring case requires different analysis because it's more important to determine if the company will return to positive cash flow first. These companies lack consistency in cash flow, which makes them less suitable for a DCF analysis.

4. Determining the Terminal Value

The terminal value is the cash flow determined by letting the current cash flow grow at a certain rate for, say, 10 years, multiplied by a reasonable multiple. So, we might say that the cash flow is $20 in 10 years and that the average multiple was 10 over the last 5 years. If we multiply $20 by 10, we get a $200 terminal value in 10 years. We need to discount this number as well by our discount rate to the power of 10 (as it's 10 years in the future).

Alternatively, the Gordon growth model can be used instead of a multiple. This model divides the cash flow in the terminal year by the difference between the discount rate and the long-term growth rate. The higher the expected growth rate in the future, the lower the denominator (e.g., discount factor – growth rate). This leads to a higher terminal value. Logically, higher future growth means the stock will be worth more. Here we focus just on the multiple.

Buffett likely pays little attention to terminal value. He focuses on the rate at which earnings will grow over the years (incremental return on invested capital) and keeps the business as long as its intrinsic value can increase:

"We do not have in mind any time or price for sale. Indeed, we are willing to hold a stock indefinitely so long as we expect the business to increase in intrinsic value at a satisfactory rate."

Source: Berkshire Hathaway Annual Report, 1987

Stock Value is a Range, Not an Exact Number

There is no exact science to determine stock value. Many investors talk about the "art of investing" because investing is an art combined with science.

You should use the DCF to determine a reasonable range for buying a stock. The DCF can help determine what price to pay to achieve a certain required return. In today's market, you'll probably find that most well-known stocks will not offer 12-15% returns due to their high prices. That means we need to be patient and wait until prices drop before buying.

Making a watchlist of companies that you understand and noting their DCF price will help you buy stocks at a reasonable price. Remember, the price you pay will determine the return you get (lower price means higher return over time). No business, no matter how good, is worth an infinite price. If you pay too much (e.g., for Microsoft), it can take 10 years or more before you recover your purchase price after a crash.

Source: www.macrotrends.net - Microsoft, although a great business, took more than 15 years to get back to its 1999 stock price

DCF Should Be Used Conservatively

DCF is likely the best tool for determining the intrinsic value of a stable company. However, assumptions about growth can greatly influence the net present value. The calculation is rather easy, but using reasonable estimates requires business knowledge and understanding of the stock market (see the investing principles of Warren Buffett).

It's wise to avoid valuing a stock if the business is unstable or if you're uncertain about future cash flows. It's far better to buy a few businesses with highly predictable cash flows at a good price. Hence, the need to operate within your circle of competence.

Conclusion

Discounted Cash Flow analysis provides a structured approach to determining a stock's intrinsic value. By carefully considering the starting cash flow, growth rate, discount rate, and terminal value, investors can establish a reasonable price range for purchasing stocks.

Remember that the assumptions you make significantly impact the calculated value. Being conservative in your estimates and focusing on businesses with predictable cash flows will increase your chances of investment success. As Warren Buffett demonstrates, understanding the principles behind DCF can help investors identify truly valuable companies and avoid overpaying for stocks.

Related Articles

- Free Cash Flow versus EBITDA - Understand why Warren Buffett focuses on cash flow rather than EBITDA

- Warren Buffett and Owner Earnings - Learn about Warren Buffett's concept of owner earnings and how to calculate it

- How Warren Buffett Invests - Discover Warren Buffett's investment criteria and philosophy

- Stock Valuation: The P/E Multiple - Explore another common method for valuing stocks