Warren Buffett and Owner Earnings - Understanding Free Cash Flow

Willem

Warren Buffett and Owner Earnings

By Willem / Originally published: 15 April 2025 / How to Invest

Table of Contents

Owner earnings is a concept introduced by Warren Buffett in 1986. It represents the cash that is available for shareholders after accounting for capital expenditures. Understanding this concept is crucial for investors because many great businesses focus on available cash rather than reported earnings.

What is Owner Earnings?

Warren Buffett first discussed the importance of owner earnings in his letter to shareholders in 1986. He used this concept to explain the actual earnings shareholders receive from Berkshire's acquisition of Scott Fetzer (a manufacturer).

Owner earnings is essentially a measure of a company's true economic profitability. It goes beyond traditional accounting measures to show the actual cash available to owners after all necessary investments to maintain and grow the business. You can learn more about this concept on Wikipedia.

"Owner earnings represent (a) reported earnings plus (b) depreciation, depletion, amortization, and certain other non-cash charges such as Company N's items (1) and (4) less (c) the average annual amount of capitalized expenditures for plant and equipment, etc. that the business requires to fully maintain its long-term competitive position and its unit volume. (If the business requires additional working capital to maintain its competitive position and unit volume, the increment also should be included in (c)."

Source: Warren Buffett, 1986 Letter to Shareholders

Cash Flow Should Include Capital Expenditures

In essence, Buffett states that the real free cash flow is the cash flow (a + b) minus capital expenditures (CAPEX). Capital expenditures (or plant, property and equipment expenditures) can be higher or lower than the amount of depreciation. He mentions an example of oil companies who often spent more than their depreciation charges.

Wall Street often reports only the cash flow without subtracting capital expenditures. Just look at the amount of EBITDA in reports, which does not include CAPEX. This can give a false presentation of the available cash to shareholders.

"Cash flow is meaningless in such businesses as manufacturing, retailing, extractive companies, and utilities because, for them, CAPEX is always significant."

Source: Warren Buffett

Cash Flow and Capital Expenditures Explained

CAPEX is reported on the balance sheet as an asset (e.g., a new machine). This means that these costs are not deducted from the profit and loss statement. Growing earnings can be the result of large CAPEX spending. Essentially, large capital investments are needed for sales growth. But the costs of this growth can be higher than the profit (net income).

This means that no real money is earned for the shareholders! Hence the need for the investor to check both the profit and loss statement and the cash flow statement. The cash flow statement reveals the Operational Cash Flow and the CAPEX. Subtracting CAPEX from the Operational Cash Flow gives the Free Cash Flow (learn more about this concept on Investopedia).

CAPEX Needs Differ by Industry

As stated in a previous article, capital expenditures (CAPEX) are necessary for maintenance and growth. For airlines and industrials, CAPEX is crucial. For other companies like cigarette manufacturers, CAPEX will be relatively small.

Coca-Cola also has relatively small CAPEX needs compared to their operational cash flow. This means they don't spend a lot of money on their machines to make sure they can generate the same revenue. A rule of thumb is seeing whether the CAPEX is less than half of the operating cash flow (CAPEX/Cash Flow < 50%).

Amazon's Focus on Free Cash Flow

Many good businesses focus on Free Cash Flow (FCF) instead of yearly earnings. Jeff Bezos (former CEO of Amazon) provides a great explanation in the annual report of 2004 about free cash flow and its importance.

"Why not focus first and foremost, as many do, on earnings, earnings per share or earnings growth? The simple answer is that earnings don't directly translate into cash flows, and shares are worth only the present value of their future cash flows, not the present value of their future earnings."

Source: Jeff Bezos, Amazon Annual Report 2004

Jeff Bezos, as a business owner, understands that the available cash is what ultimately counts. The value of a stock is determined by estimating the amount of cash that the business will generate in the future. The value of this future cash flow today is determined by using the discounted cash flow analysis (DCF).

CEOs of companies who focus heavily on adjusted earnings and earnings before depreciation should be analyzed with extra care. A general assumption would be that capital expenditures (costs for machines, property, and equipment) are not subtracted from the operational cash flow as this would reveal an unsatisfactory result.

Apple's Free Cash Flow Example

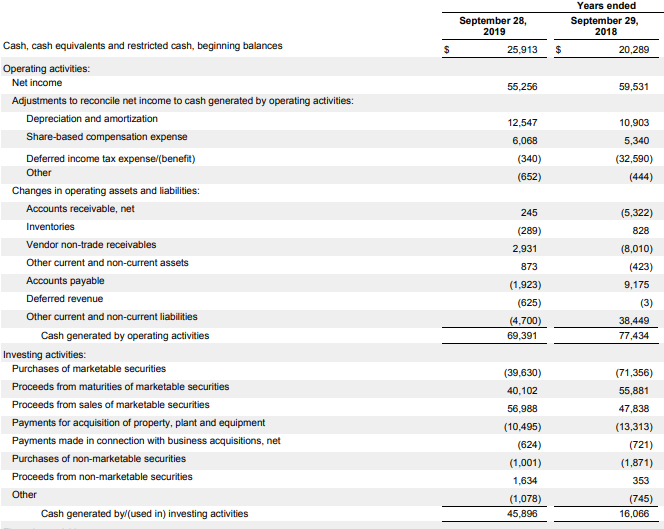

Let's look at a real example of a cash flow statement from the annual report of Apple to see how the free cash flow is calculated. The cash flow statement has 3 main parts:

- • Operating activities (describes how much cash the business generates with its core business)

- • Investing activities (lists mainly investments in CAPEX and securities (other investments))

- • Financing activities (shows debt changes, dividends and stock repurchases)

Here we focus on part 1 and the CAPEX (plant, property and equipment) that can be found in part 2 (investing activities).

Apple's Free Cash Flow Calculation

We take the net income from the profit and loss statement and adjust for cash and non-cash expenditures. Depreciation and amortization are added back as they represent earlier cash outlays for machines and goodwill. Accounting rules state that due to the longer life of most assets, a business can deduct the costs over e.g., 10 years from the earnings. So, a machine of $10,000 causes a decrease in earnings of $1,000 per year for 10 years. The yearly $1,000 is no longer a cash outlay, hence added back on the cash flow statement.

Changes in operating assets and liabilities means changes in the working capital. Simply put, does the business require more cash to operate compared to last year? Decreasing accounts receivable and lower inventory means more cash and vice versa.

I'm ignoring the other items like stock compensation (you could argue that this is a cost) for simplicity. Apple's operating activities generated a cash flow of $69,391 million. The next step is to check the CAPEX, which is $10,495 million. This leads to a free cash flow of $58,896 million (Cash flow from operations minus CAPEX). The Free Cash Flow is the money that is available to buy back stocks, pay dividends, or make acquisitions. Apple has a very healthy free cash flow track record.

Statement of cash flows from Apple's 2019 Annual Report. Source: Apple Investor Relations

Negative or Decreasing Shareholder Equity

Note that due to strong buybacks, a company's shareholder equity can turn negative. Learn more about this concept on Old School Value. Shareholder's equity increases by adding net income (or decreases with a loss).

In the case of Apple, shareholder equity decreases due to strong buybacks, which in this case is not a problem as long as the buybacks make economic sense. You can track Apple's historical shareholder equity on Macrotrends.

Today, Apple faces other concerns given the trade war which leads to high uncertainty about the prices they have to pay for their product inputs (materials like chips and the iPhone screen). Learn more on CNBC and The Wall Street Journal.

Conclusion

Owner earnings is the cash generated by the operations of the business minus the capital requirements. Owner earnings is similar to Free Cash Flow, although ideally, you want to separate CAPEX into maintenance and growth parts, as growth CAPEX can lead to additional production capacity.

Focusing on businesses that have a healthy free cash flow will help to reduce investment risk (learn more about understanding investment risk). Ultimately, the Free Cash Flow will determine the value of the business and is used in the DCF analysis.

Related Articles

- How Warren Buffett Invests in Stocks - Learn about Warren Buffett's investment criteria and philosophy

- Understanding Investment Risk - Discover how to assess and manage risk in your investment portfolio

- Book Value and Intrinsic Value - A comprehensive guide to understanding valuation concepts for stock analysis