The Importance of Book Value and the Balance Sheet - Understanding Intrinsic Value

Willem

The Importance of Book Value and the Balance Sheet

By Willem / Originally published: 2020 / How to Invest

Table of Contents

- 1. The Balance Sheet and Book Value

- 2. What is a Strong Balance Sheet?

- 3. Apple's Balance Sheet Example

- 4. Book Value Can Be Over or Understated

- 5. Book Value is Not the Same as Intrinsic Value

- 6. Wisdom from Benjamin Graham and Warren Buffett

- 7. Warren Buffett on Economic Goodwill

- 8. Putting Book Value in the Right Perspective

What is a good balance sheet and is book value equal to the intrinsic value? This article states some of the key things to look for on the balance sheet and explains that intrinsic value is often falsely seen as equivalent to book value. In the end, the most important factor is what the company can earn with the assets found on the balance sheet.

The Balance Sheet and Book Value

A balance sheet (balance meaning that both sides are equal 'in balance') shows the assets, equity and liabilities of a company. Simply said, it shows what the company owns that produce money (assets like inventory and a factory) and how this is financed (liabilities (debt) and equity). The balance sheet is a snapshot of the assets and liabilities of the company at a given time.

Assets – Liabilities = Equity (or book value).

The equity is also called shareholders' equity or book value. Dividing the book value over the total number of outstanding shares will give you the book value per share. This book value per share is used in the P/B ratio (price of the share / book value per share).

See Investopedia's balance sheet guide to read more about the balance sheet.

What is a Strong Balance Sheet?

The balance sheet differs per industry. In general, growing cash and equivalents, decreasing debt and increasing shareholders' equity are positive signs. Strong businesses do not need a lot of debt to operate and generate enough cash to pay down debt. Good businesses also have the ability to retain earnings (this increases equity) and to reinvest this at high returns. Furthermore, companies can purchase back shares which will also show up on the balance sheet.

A rule of thumb for the balance sheet health is often a debt to equity ratio of 0.5 (meaning 2 dollars of equity for every dollar of debt). However, companies like Unilever, Coca-Cola and Procter & Gamble have higher D/E ratios than 0.5. This is mainly due to their strong economics which allows them to have the luxury of not having to retain much equity. They often get paid before they need to pay their bills. Furthermore, it is relatively easy for these companies to get a loan if needed.

Industrials (e.g. General Electric) often need large working capital to finance their services for their clients (they get paid later). So, balance sheets can vary by industry and some industry knowledge is needed to determine if the balance sheet is healthy. Analyzing changes in the balance sheet over a time period (5-10 years) is very useful to discover improving or decreasing financial health.

Apple's Balance Sheet Example

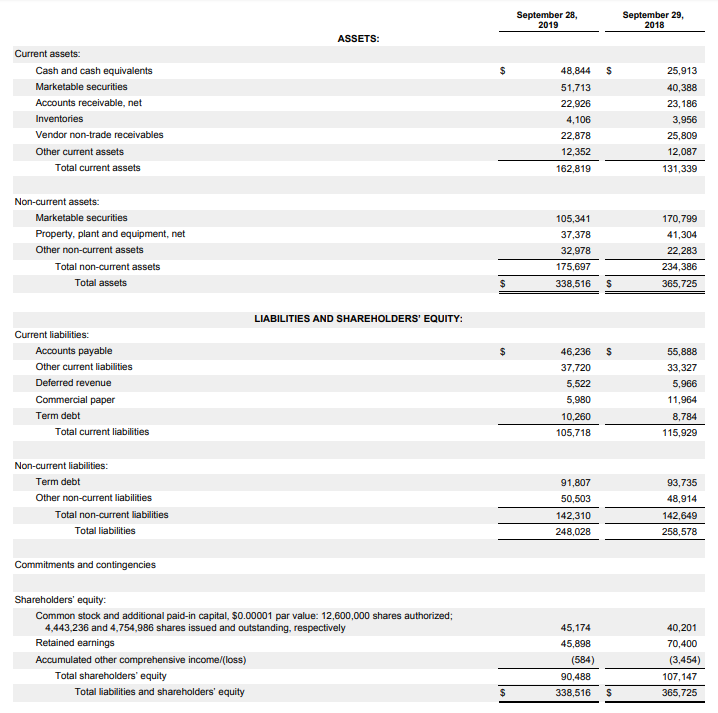

Below you can find the balance sheet from the 2019 Annual Report (10-k) of Apple. Just a quick scan shows that between 2018 and 2019:

- • Cash improved from 25,913 billion to 48,844 billion

- • Marketable securities increased with more than 10 billion (can be quickly converted to cash)

- • Long Term debt (non-current liabilities) decreased to just under 92 billion (note that Apple's cash and marketable securities are enough to pay down debt)

- • Shareholders equity went from 107 to 90.5 billion mainly due to share buy-backs and dividends (this can be found on page 32 of the annual report of 2019)

In sum, this is a strong balance sheet as there is enough cash and equity and not much debt. And more importantly, Apple can generate consistently huge amounts of cash with its assets! High returns on capital, low debt, good management (how Warren Buffett invests in stocks)… no wonder Warren Buffett concentrated (stock portfolio selection) more than 25% of his stock portfolio in Apple.

Source: Apple Investor Relations - SEC Filings

Book Value Can Be Over or Understated

Quite often, people perceive a business as undervalued simply because the price to book (P/B) ratio is lower than 1. This means that the assets per share are worth more than the price of the share. Of course, this is according to the accounting figures.

Logically, the assets might not be worth as much as is mentioned on the book. In times of economic distress, assets are often sold for prices under the book value. Inventory is likely worth much less if a company goes bankrupt. Of course, it could also be true that the assets are worth more than their historic book value. An example is real estate that is listed in the books for prices from years ago.

Another example of how the intrinsic value can be understated by the book is due to the writing off (amortization) of goodwill. A company must state "goodwill" on the asset side of its balance sheet if it pays more than the book value for an acquired company. Warren Buffett argues in his 1999 letter to shareholders that the real economic value of good acquired businesses grows over time. Hence, writing off of goodwill understates the true value.

Book Value is Not the Same as Intrinsic Value!

Never assume that a company is undervalued simply because the price of the share is lower than the book value (e.g. a P/B under 1)! It is about what the company can earn with the book, not about the amount of assets. Coca-Cola trades at a P/B of more than 10! Of course, we know that the brand and the feelings that we get when thinking about Coca-Cola really determine the value.

A lot of European banks on the other hand have P/B ratios lower than 1. Most of them also have very low returns on assets and equity. So, one could argue that it is fair that these banks trade below their book value. The book (the loans of the banks basically) does not earn enough fee and interest income compared to the capital used.

Some Wisdom from Benjamin Graham and Warren Buffett on Book Value

In the 1934 and 1940 edition of Security Analysis by Benjamin Graham it is pointed out that it is a great mistake to rely just on book value:

"Some time ago intrinsic value (in the case of a common stock) was thought to be about the same thing as "book value," i.e., it was equal to the net assets of the business, fairly priced. This view of intrinsic value was quite definite, but it proved almost worthless as a practical matter because neither the average earnings nor the average market price evinced any tendency to be governed by the book value."

Graham, Security Analysis 1934 and 1940

Additionally, Warren Buffett said in his letter of 1983 the following about book value and intrinsic value:

"Book value is an accounting concept, recording the accumulated financial input from both contributed capital and retained earnings. Intrinsic business value is an economic concept, estimating future cash output discounted to present value. Book value tells you what has been put in; intrinsic business value estimates what can be taken out."

Warren Buffett About the Power of Economic Goodwill

Probably one of the best letters to investors of Warren Buffett is the one of 1983 with the appendix that explains economic goodwill.

Warren Buffett describes in his letter that the fewer assets a company needs to produce a certain level of income, the better. For example, if a company turns over its inventory fast, then less inventory is needed at a given point in time. This means that less capital is needed to run the business and the chances of getting obsolete inventory are lower. Furthermore, the company has to spend relatively less on new inventory (compared to companies that need more assets) during inflationary times. Simply said, the low asset company needs to buy less new expensive assets (inflation increases the prices for the inventory). A high turnover of assets combined with high margins leads to a high return on capital.

"Businesses logically are worth far more than net tangible assets when they can be expected to produce earnings on such assets considerably in excess of market rates of return. The capitalized value of this excess return is economic Goodwill."

In summary, Warren Buffett likes a business that has economic goodwill (like Coca-Cola) because this means that less tangible capital (like inventory) is needed to generate income. A business that needs fewer tangible assets to produce the same amount of earnings as a company with more tangible assets is preferred. Buffett in such cases ignores goodwill and talks about return on net tangible assets.

Putting Book Value in the Right Perspective

The balance sheet and the book value (or equity value) is very important to determine the financial health of a company. Also, the balance sheet helps to determine how profitably the company uses its assets. But ultimately, it is about what the company can produce over time (the earnings power). Excellent businesses that generate a lot of cash often don't need much debt and have strong balance sheets.

Remember to not make the mistake of simply using a P/B ratio to determine the intrinsic value of a company. The intrinsic value is determined by the cash flows that a company earns and will earn. And is not as definite as a book value at a certain point in time.

Related Articles

- • How Warren Buffett Invests in Stocks - Learn about Warren Buffett's investment criteria and philosophy

- • Stock Valuation: The P/E Multiple - Discover how to use P/E ratios for stock valuation

- • An Introduction to ETF Index Investing - Learn why Warren Buffett recommends index funds for most investors