Stock Valuation: The P/E Multiple - Understanding Price to Earnings Ratios

Willem

Stock Valuation: The P/E Multiple

By Willem / Originally published: 2019 / How to Invest

Table of Contents

- 1. What is a P/E Multiple?

- 2. A Real Estate Example

- 3. Common View on the P/E Multiple

- 4. Stock Valuation by Using the Multiple

- 5. Warren Buffett's View on Multiples

- 6. Why You Should Not Rely Just on a Multiple

- 7. Factors That Determine the Multiple

- 8. Examples of Using Multiples to Screen

- 9. Short Note on Book Value Multiples

- 10. Conclusion: It's About the Fundamentals

The P/E multiple is often used for stock valuation. This is understandable, as it is relatively easy to use to screen for a potential investment. However, a good understanding of the benefits and pitfalls of multiples is vital before you buy a company solely based on its P/E ratio.

What is a P/E Multiple?

One of the most common metrics used for stock valuation is the P/E multiple. The P/E multiple is simply the price of the stock over the earnings per share.

Another way to look at the P/E multiple is to see it as the earnings yield.

The earnings yield is simply the inverse or "other way around" of the P/E. The earnings yield shows the return of the investment if the price and earnings stay the same. A real estate example will clarify this.

A Real Estate Example

Assume that you buy a house for $100,000 and you receive a rent of $10,000. The rent can be pictured as the earnings per share (E) and the price of the house can be seen as the share price (P). Now, if we divide the EPS over the Price, we will get 10 ($100,000 / $10,000). This would be the P/E multiple. If we divide E over P, we will get 10% ($10k / $100k). So, if you buy a house for 100k and rent it out for 10k, then you receive a 10 percent return on your investment (before costs).

The earnings yield for the house would be 20% for example if the rent is 20k instead of 10k. The P/E would in that case be 5 instead of 10 (100k / 20k). You can use this way of thinking as well to analyze a stock. A P/E of 20 will yield 5% (1/20 = 5%). This means that is takes 20 years to get your investment back. If the P/E is 10, then it will take 10 years with a yield of 10% (1/10).

Common View on the P/E Multiple

Generally, a low P/E and high earnings yield is generally considered cheap and positive and a high P/E is seen as expensive. The earnings per share are found on the income statement. It is the total net income that the company has earned (revenue minus the costs) divided by the number of outstanding shares.

The P/E can quickly show if a stock is relatively cheap or expensive. The P/E can be compared to the past record of the company (e.g. 10 years) and the industry (P/E multiples differ depending on how the market looks at the industry prospects).

A low P/E multiple can indeed mean that a stock is cheap compared to its past. But it can also mean that a stock has a lower valuation due to decreasing fundamentals. Ultimately, the fundamentals of a business will determine if a stock will be a good buy for the investor. We will discuss this further in the next subsections.

Stock Valuation by Using the Multiple

The stock price is simply determined by the earnings per share multiplied by the P/E multiple. So, a company that earns $1 per share and has a P/E multiple of 10 will trade at $10 on the stock exchange. This can be shown in a formula:

Share price = current earnings per share x P/E multiple

Many stock analysts try to determine the future earnings per share (EPS) and then multiply this by the average P/E ratio of a company. You could for example take the current EPS and multiply this with an estimated growth rate.

Assume that you found that the earnings grow on average with 10 percent during the last 10 years. The current EPS is $1. Then you can assume (if all factors remain constant) that the EPS next year will be $1.1 ($1 x 10%). If the P/E multiple is 10, then the price next year will be $11 instead of the current $10.

Note that this example is not taking into consideration the time value of money. This means that a dollar in the future is worth less than a dollar today because you can invest your money in a Treasury Bond for example. That is why you need to discount future earnings. Learn more about this concept in our article on the time value of money.

Another essential investing skill is to make sure that you correctly estimate the future EPS, growth rate and discount rate of a stock. Warren Buffett is looking at stable companies that have a competitive advantage. This makes it easier to estimate the future earnings due to the steady average growth in earnings (see how Warren Buffett invests in stocks).

Warren Buffett and His View on Multiples and Intrinsic Value

Before we dive further into the P/E multiples, it should be mentioned that Warren Buffett is not looking at multiples to determine the intrinsic value of an investment. Warren Buffett looks at the cash a company will produce between 'now and judgement day' and then discounts it with an appropriate discount rate.

DCF (discounted cash flows) is the method that Warren Buffett is using to find the intrinsic value of a stock (i.e. the value today of the cash that a company will produce in the future). Note that the DCF analysis is very sensitive to the assumptions of growth and the discount rate. Hence, it requires a good understanding of the business and valuation to come up with a reasonable valuation.

Warren Buffett shared his view on price to earnings multiples in his letter to shareholders of 1992:

"Whether appropriate or not, the term 'value investing' is widely used. Typically, it connotes the purchase of stocks having attributes such as a low ratio of price to book value, a low price-earnings ratio, or a high dividend yield. Unfortunately, such characteristics, even if they appear in combination, are far from determinative as to whether an investor is indeed buying something for what it is worth and is therefore truly operating on the principle of obtaining value in his investments. Correspondingly, opposite characteristics - a high ratio of price to book value, a high price-earnings ratio, and a low dividend yield - are in no way inconsistent with a 'value' purchase."

Why You Should Not Rely Just on a Multiple

Unfortunately, investing is not as simple as looking at the P/E. Note that multiples tell you nothing about the moat of the business (its competitive advantage), the margins, return on capital, the amount of debt, growth, cash flow and the management for example.

Furthermore, the P/E multiple looks at the past as it uses the earnings that have already been reported. Historic returns (especially stability) are important to analyze but are not enough to determine if a stock will do well in the future. If you use the P/E, it can be smart to also look at the forward P/E which incorporates the earning estimates of analysts. The average earnings of e.g. the last 10 years can determine if the company has a stable growing earnings pattern.

Of course, you need to determine yourself if the earnings estimates make any sense to you.

As mentioned in how to create an investment expectation, P/E multiples can even be especially misleading in case you are trying to evaluate a cyclical company. This is because the market assumes that the price of cyclical stocks will fall (so the P goes down), while the earnings are still high due to the past record.

Which Factors Determine the Multiple?

A better way to think about the P/E multiple is to see it as a quality factor (or quality coefficient as it is called in the book Security Analysis of Benjamin Graham). The market will attach a higher multiple to the earnings of a stock if the company has for example favorable prospects. Simply put, the higher the quality of the company, the higher the multiple. The market can be wrong at times by under- or overestimating the prospects of a company.

The book Security Analysis 1940 edition by Benjamin Graham names the following factors that determine the multiple:

- a. The dividend rate and record.

- b. The standing of the company—its size, reputation, financial position, and prospects.

- c. The type of business (e.g., a cigarette manufacturer will sell at a higher multiple of earnings than a cigar company).

- d. The temper of the general market. (Bull-market multipliers are larger than those used in bear markets.)

Benjamin Graham's most famous book The Intelligent Investor (1973) lists as most important determinants for the P/E multiple:

- 1 General Long-Term Prospects of the company (mostly growth and earnings).

- 2 Management.

- 3 Financial strength and capital structure (enough cash and equity and not much debt).

- 4 Dividend record.

- 5 Current dividend rate.

Note that the multiple is very much relying on the appraisal of what the market thinks will happen to the earnings of a company. It is not said that this will indeed happen. There are more factors that determine the multiple, like the government's attitude towards stocks for example and the interest rate. But the factors described above explain quite well why a stock multiple has a certain value.

The P/E Ratio and Institutional Buyers

P/E increases over time as a company becomes more successful and attracts institutional buyers (e.g. pension funds and asset managers who invest large sums of money). Companies can increase significantly in value simply by a higher demand for their stock due to increased institutional interest.

The Market Can Overlook a Sector or Company

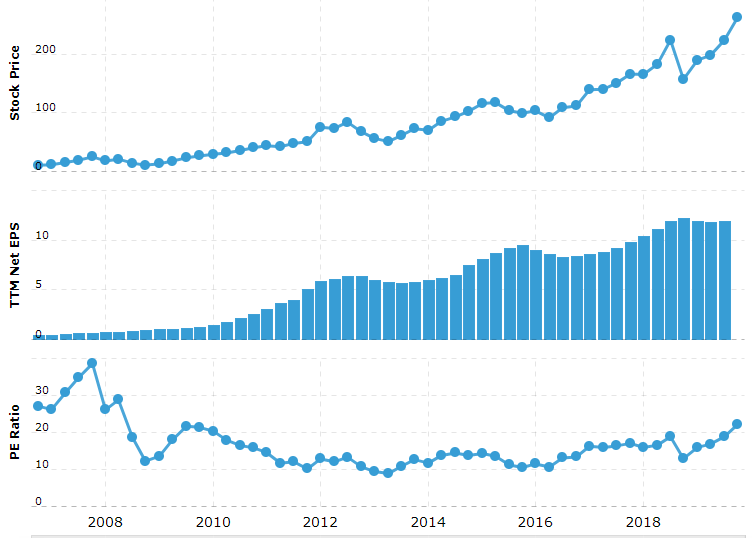

Apple's P/E ratio increased from approximately 13 to 22 in 2019, while earnings per share were flat (see graph below). So, the market's assessment of Apple's future earnings (the market was very worried about the earnings of Apple at the beginning of 2019) is likely explaining the improved P/E. Of course, this is not the only factor, but probably an important one.

Apple's EPS and P/E multiple (macrotrends.net).

Underlying Facts Determine if a Stock is Cheap

In general, buying businesses with a low P/E means that you don't overpay on average for the earnings of a company. The trick is of course for the investor to determine the fundaments underneath the P/E to see if the company is really a good buy.

Growth of the earnings of a company is an important underlying fact that determines the value of a stock over time. Growth alone will not mean something is cheap or expensive. The costs and benefits of growth are more important. The airline business was able to grow fast for years, but the costs to run an airline are so high that most investors suffered from poor investing returns. Growth makes sense if a company has a competitive advantage so that the business can raise prices more than its costs.

Peter Lynch's rule of thumb is to buy a stock at a P/E multiple that is equal to the growth rate. A company that has a lower P/E multiple than its growth rate could be a potential bargain. (More from Peter Lynch: how to create an investment expectation)

Examples of Using Multiples to Screen

AT&T is an example of a relatively good and established business. But Telco's have large capital expenditures (the networks and cables don't come cheap) and AT&T produced low returns on equity. This is mentioned by Warren Buffett as one of the reasons why he was not interested in buying AT&T.

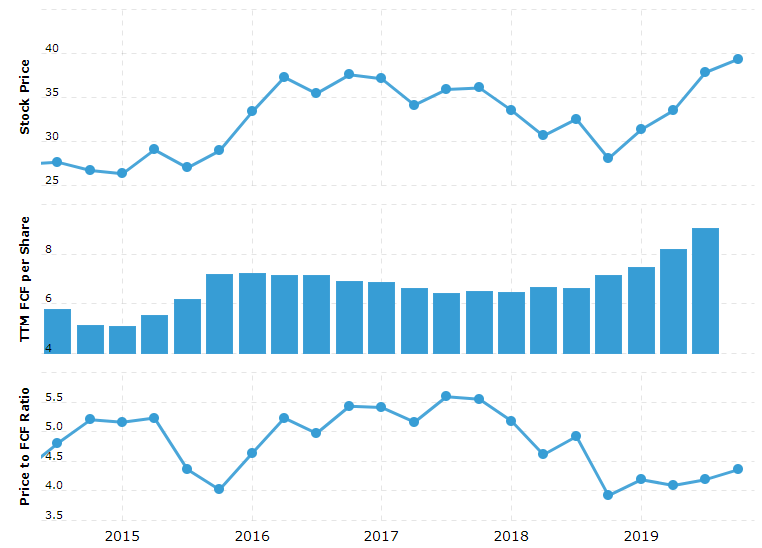

But even without superb returns, an established business like AT&T can still be a good investment and could have been found with P/E screening or P/FCF screening. Note that P/FCF is Price / Free Cash Flow. Free Cash Flow (FCF) measures the cash that a company generates from its operations (its core business) minus the capital expenditures (plant, property and equipment). The earnings can be distorted due to impairment charges (these charges are deducted from the revenue, but are not actual cash outlays), so FCF screening can give a more constant picture. Impairment charges are often the result of paying too much for a take-over.

AT&T FCF per share(macrotrends.net).

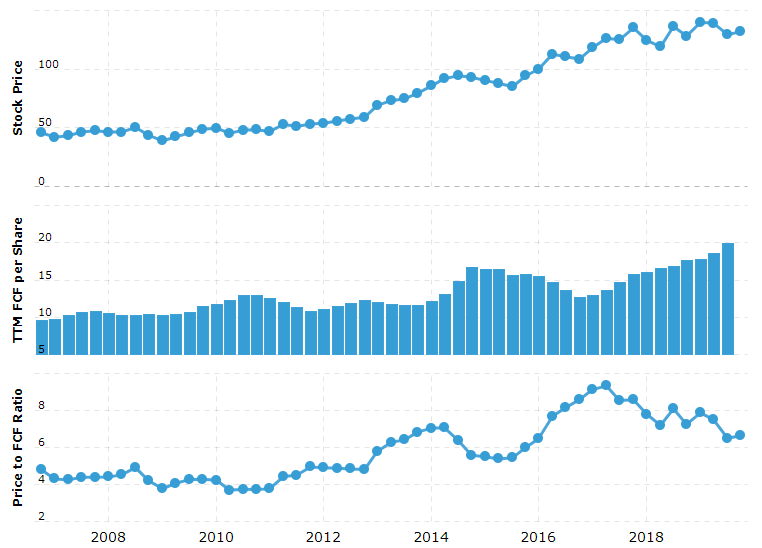

JNJ FCF per share(macrotrends.net).

An example of a good company is Johnson & Johnson (years of good cash flows, strong returns on capital, high margins and dividend growth and a company that Warren Buffett owned).

A low P/E or P/FCF for Johnson & Johnson (J&J) is probably due to a temporary legal issue (or something similar that is hurting the businesses in the short term) and something that J&J will overcome. A bad company with a P/E of 2 can be very expensive if it is not generating enough cash to pay for its costs.

Short Note on Book Value Multiples

Another often used multiple is the price to book ratio. Warren Buffett does not look at the P/B ratio. He looks mainly at the margins, Return on Capital and Cash Flow that the book is generating. The less inventory and assets the better. This means that less money is required to run the business. The balance sheet is very important to determine the capital structure (amount of debt, equity, cash) and to see which assets the company uses to generate cash.

Always study the income statement, balance sheet and cash flow statement to determine if you are buying a great business. An example found in Security Analysis is how companies can boost their income by manipulating their surplus (deducting losses from surplus instead of revenue) or by using more debt to increase returns on equity. So never just solely rely on reported earnings from an income statement.

Conclusion: It's About the Fundamentals

In sum, a low P/E does not mean that you are a value investor and neither does a high P/E mean that you're not a value investor. Following the steps of Warren Buffett will help to find a great value investment. But note that this takes a lot of time and discipline. That's why Warren Buffett recommends an Index Fund that replicates the S&P 500 (an introduction to ETF index investing).

Stock valuation via the P/E multiple can give a good first impression for a potential good buy. Hopefully, it is clear by now that solely relying on the P/E multiple is not enough. It is crucial to look at the underlying fundamentals of a stock and to be aware of the investing principles (the investing principles of Warren Buffett).

P/E multiples can be low due to very valid reasons like high debt, low growth or other business problems. Nonetheless, the P/E multiple can still serve as a screening instrument, especially for more established businesses that are temporarily cheap due to a solvable business issue or legal situation. The good thing is that these companies are a legitimate buy due to their strong fundamentals (e.g. cash flow and return on capital).

Related Articles

- How Warren Buffett Invests in Stocks - Learn about Warren Buffett's investment criteria and philosophy

- An Introduction to ETF Index Investing - Discover why Warren Buffett recommends index funds for most investors

- How to Create an Investment Expectation - Learn about Peter Lynch's approach to investment analysis