The Best Business According to Warren Buffett: High Return on Tangible Capital

Willem

The Best Business According to Warren Buffett

By Willem / Originally published: 20 November 2021 / Investment Analysis

Table of Contents

- 1. Introduction

- 2. High Returns on Tangible Capital

- 3. Warren Buffett on Capital Requirements

- 4. Google, Facebook, and Microsoft Comparison

- 5. A Simple Check for Spotting High Returns on Capital

- 6. Retaining and Reinvesting Capital

- 7. Characteristics of the Best Business

- 8. A Royalty on the Growth of Others

- 9. Conclusion

Introduction

What is the best business according to Warren Buffett? A business that has the highest rate of return on tangible capital over time. This requires specific characteristics that will be discussed in this article. Finding such a business can greatly increase your investment returns over time.

High Returns on Tangible Capital

Warren Buffett has mentioned what he considers to be the best business in many letters. For example, in his 2019 letter to shareholders, he discusses his selection criteria:

"In addition, we constantly seek to buy new businesses that meet three criteria. First, they must earn good returns on the net tangible capital required in their operation. Second, they must be run by able and honest managers. Finally, they must be available at a sensible price."

Source: Buffett Letter to Shareholders 2019

What is Return on Tangible Capital?

Net tangible capital means that Buffett looks at the investments that a company must make to operate. A company needs inventory, accounts receivable, and fixed assets to produce its goods/services. Goodwill is an intangible asset that can include the brand name used to create a franchise for which customers are willing to pay (e.g., the brand Coca-Cola).

Goodwill is ignored by Warren Buffett when he looks at great businesses. The tangible assets must be replaced over time, which means that the company has to spend money. The goodwill does not need to be replaced. The more economic goodwill (goodwill that leads to above-average returns), the better. This means that the company requires less capital to operate (less spending, more cash for shareholders). Hence, the return on net tangible capital (free cash flow divided by tangible capital) is a crucial metric.

Warren Buffett on Capital Requirements

Buffett names Microsoft and Google in 2007 as examples of companies that can increase their earnings without the need to spend much. Too many fast-growing companies need to fund their growth with large capital expenditures, meaning that no money is left for shareholders.

"It's far better to have an ever-increasing stream of earnings with virtually no major capital requirements. Ask Microsoft or Google."

Source: Warren Buffett, 2007 Letter to Shareholders

Generating high returns on capital leads to lots of cash that will keep on snowballing over the years.

Google, Facebook, and Microsoft Comparison

Google and Facebook – Free Cash Flow and Capital Expenditures

Note that Google, for instance, does make large capital expenditures (capex) for their data centers in 2020. But a lot of this capex is for growth and not only maintenance of the servers. The 2019 annual report of Google (Alphabet) shows the following about capex:

"Our capital expenditures have grown over the last several years. We expect this trend to continue in the long term as we invest heavily in land and buildings for data centers and offices, and information technology infrastructure, which includes servers and network equipment."

Source: Alphabet 10K, 2019

- Operating cash flow was $54.5 billion

- Capital expenditures were $23.5 billion

Let's compare Facebook and Google

Facebook (a close competitor) has capex of $15.65 billion and an operational cash flow of $36.31 billion. Source: Facebook Investor Relations. Capex will even be 17-19 billion next year according to FB's latest annual report. Both Google and Facebook need to spend a lot on capex to stay on top of their game. Fortunately, the operational cash flow is also growing, which leads to satisfying free cash flow results for investors. For more on this topic, see EBITDA versus Free Cash Flow Examples.

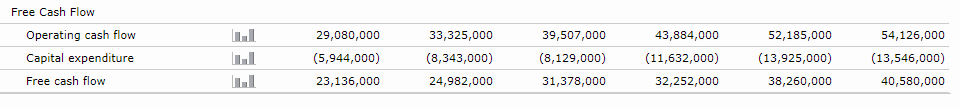

Microsoft – An Example of an Outstanding Business

The capex expenditures for Microsoft are still relatively small compared to the operating cash flow. So, Microsoft can produce a lot of free cash flow. At the end of the article, we find one of the reasons for the relatively low capex of Microsoft.

Microsoft spends a smaller amount on capex of its operating cash flow 2015-2020 TTM (source: www.morningstar.com)

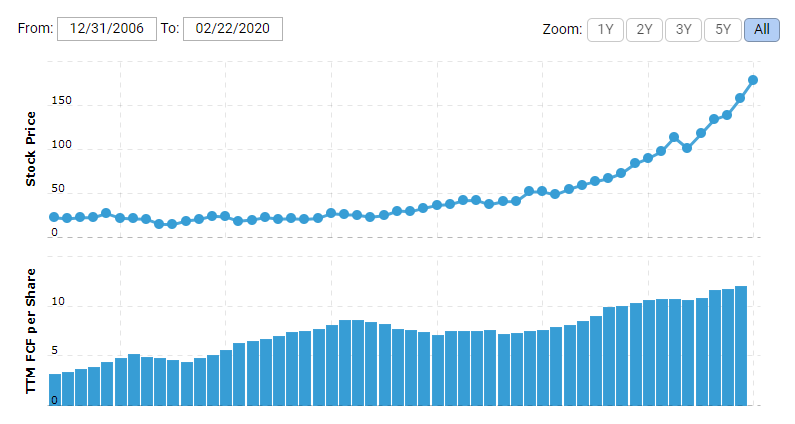

Microsoft Free Cash Flow per Share 2006-2020 (source: www.macrotrends.net)

A Simple Check for Spotting High Returns on Capital

"Leaving the question of price aside, the best business to own is one that over an extended period can employ large amounts of incremental capital at very high rates of return."

Source: Berkshire Hathaway Annual Report, 1992

You will find this by looking at how much capital (long-term debt and equity, e.g., retained earnings) the company adds over, let's say, 10 years. Then you can compare this to the additional free cash flow that the business generated in the same period. This can give a good indication of how effective the business was in allocating capital to generate earnings.

By looking at the last 5 or 10 years, you incorporate only the incremental capital and not the capital that was already invested in the business. This will allow the investor to see if the high returns are produced with new investments. Often, mature companies return much of their earnings to shareholders instead of reinvesting it. This leads to lower incremental (additional) returns on capital.

Retaining and Reinvesting Capital

A business that can invest in high-return investments can best serve its shareholders by retaining its capital. This will add much more value to the stock than simply paying the capital out in dividends. A restaurant chain with high same-store sales (the additional sales of a new store) can best use the capital to open more stores, as long as the additional return is satisfying.

The 1-dollar market rule of Warren Buffett (see How Warren Buffett Invests in Stocks) can also be checked by seeing how the market value changed over 10 years and how much capital was retained. 1 dollar retained should generate at least one dollar of additional market value over the years.

"Truly great businesses, earning huge returns on tangible assets, can't for any extended period reinvest a large portion of their earnings internally at high rates of return."

Source: Warren Buffett, 2007 Letter

The worst business is a company that grows fast and uses a lot of capital without earning much additional cash! Warren Buffett names airlines as an example in 2007. Note that Buffett later owned airlines, likely due to the low purchasing price compared to the earnings. A low price compared to (stable) earnings can still be a good buy.

Characteristics of the Best Business

The book Money Masters by John Train lists, besides investor behavior (see Warren Buffett's View on Investor Behavior), the characteristics of the best business. Let's go briefly over some of these best business qualities and see what Buffett means:

- 1. Good return on capital without much debt - Debt can leverage the returns but increases risk (see Understanding Investment Risk)

- 2. Understandable - You must know how the business earns its money

- 3. They see their profits in cash - See owner's earnings or free cash flow (Warren Buffett and Owner Earnings)

- 4. Strong franchises and freedom to price - Competitive advantage/moat and the ability to raise prices above the market average and inflation

- 5. They don't take a genius to run - Coca-Cola's success doesn't depend on one typical CEO

- 6. Predictable earnings - Otherwise, you can't predict the future cash flows

- 7. Low inventory and high turnover of the assets - Meaning that less money is invested in the business and higher returns on capital because you sell your inventory fast

- 8. Management cares about the business owners - The stockholders

- 9. The best business has a royalty on the growth of others

A Royalty on the Growth of Others

The "having a royalty on the growth of others" is best understood by thinking of a company that can use the expenditures of another company to its advantage. Microsoft is a good example. Companies like AT&T pay for the internet and network. IBM makes the computers. These things require a lot of capital that has to be invested and that is stuck in inventory and accounts receivables. Microsoft used this to its advantage by supplying computers with software (Windows and Office).

The marginal costs (costs of one additional service/product) for Microsoft are almost zero to supply an additional computer with software. They could simply grow along with the investments of other companies. Facebook is another example. The users are creating the content, and Facebook has a huge gross margin due to its low costs of goods sold (it has no inventory).

Only a few businesses qualify as 'best business,' but when you find such a stock, you don't have to worry about falling market prices and recessions. Warren Buffett doesn't worry how current events will affect the market.

Conclusion

Finding the best business requires a very good understanding of investing characteristics and principles. This will ensure the investor that the business is good and will remain able to produce a lot of cash for the shareholders. Confidence and compounding knowledge will help to allocate a respectable amount of wealth to such an investing idea. Over time, the compounding will do the magic of increasing your wealth.

Again, a fair warning must be given that this requires discipline, skill, and a good understanding of the risks. For instance, overpaying can deteriorate the returns significantly. Index funds will serve the needs of most investors by offering a satisfying return over the long run without the need to perform research. See An Introduction to ETF Index Investing.

Related Articles

- How Warren Buffett Invests - Learn about Warren Buffett's investment criteria and how he selects companies

- Warren Buffett and Owner Earnings - Understand how Warren Buffett calculates the true earnings of a business

- Free Cash Flow versus EBITDA - Why free cash flow is a better metric than EBITDA for valuing businesses

- Understanding Investment Risk - Learn about different types of investment risks and how to manage them

- How to Value a Stock with DCF Analysis - A comprehensive guide to valuing stocks using discounted cash flow analysis